Vol. 39 (Nº31) Year 2018. Page 2

Vol. 39 (Nº31) Year 2018. Page 2

Elena E. UDOVIK 1; Margarita N. KUZINA 2; Maria V. SHKURATOVA 3; Natalya V. MALINOVSKAYA 4; Svetlana N. UGRIMOVA 5

Received: 18/03/2018 • Approved: 21/04/2018

ABSTRACT: Competition is an economic process of interaction, interconnection and struggle between the enterprises acting on the market in order to provide better sales opportunities for their products, meet the needs of customers and obtain the greatest profit. Modern competition as an integral attribute of the world market. Industrialization of economic life expands the mass base of competition. Along with giant monopolies, medium, small and even very small firms enter the market struggle. |

RESUMEN: La competencia es un proceso económico de interacción, interconexión y lucha entre las empresas que actúan en el mercado para proporcionar mejores oportunidades de venta para sus productos, satisfacer las necesidades de los clientes y obtener los mayores beneficios. La competencia moderna como un atributo integral del mercado mundial. La industrialización de la vida económica expande la base de masas de la competencia. Junto con los monopolios gigantes, las empresas medianas, pequeñas e incluso muy pequeñas entran en la lucha del mercado. |

International competition is the competition between resident companies of different countries in national and world markets.

The successful running of a company's business in an international (global) competitive environment presupposes, first of all, adaptability to the requirements of the specified environment and ability to derive benefits from it in accordance with its goals and objectives (Adcock, 2006; Porter, 2006).

These skills and abilities form the core competencies of the company.

Competence is the ability to correctly apply knowledge and skills (know-how) to solve specific problems in these specific situations.

Key competencies of the company:

These key competencies of the company, together with other factors of its competitiveness, constitute competitive advantages (Ovchinnikov, 2011).

The system of international competitive advantages of the company consists of the following main elements:

Successful implementation of this system of international competitive advantages is manifested in the corresponding stable position of the company in world markets. This position is the international competitiveness of the company.

Specific ways of the company's practical transformation of its system of international competitive advantages into the corresponding stable competitive position in the world markets are the international competitive strategies of the company (Marmashova, 2011; Reback, 2009).

Since in the functioning system of international business the leading place belongs to companies that conduct business in a competitive global environment of interstate interaction, it is advisable to consider and evaluate the features of international competition using the concepts: “international competitive advantages of the company”, “international competitiveness of the company”, “international competitive strategies of the company” (Kirtsner, 2011; Kuleshova, 2012).

This approach to the analysis of international competition is predominantly embodied in the works of M. Porter, the world's leading expert on international competition. In the further presentation of the material of this topic, we will rely on the main ideas, theoretical and methodological approaches of this researcher.

American scientist M. Porter defined international competition as a rivalry for competitive advantages. Taking the idea of D. Ricardo as “the standardization of comparative absolute advantages of market subjects” and analyzing the entire set of factors influencing achievement of these advantages in the world market, he suggests examining international competition as a triune process that characterizes:

In the first two cases, we are talking about the fact that the determinants in question can each individually contribute to or impede national success, and the use of the determinants of the third group implies the creation of an integrated dynamic system (Wright, 2006).

If we examine the scheme of formation of competition offered by M. Porter, it is not difficult to see that it is a question of creating a single reproductive mechanism of the economy, where the dynamics of the national advantage is determined by the productivity of relations in all diversity as a single economic organism, and not by individual parties, for example, export of those or other goods.

Therefore, the success of foreign policy of any country depends on the general state of the economy of its domestic market and the effectiveness of foreign economic relations. M. Porter proceeded from the assumption that competitive advantages are realized not separately, but are related to what can be called “clusters” (bundles) consisting of industries that depend on each other.

Further M. Porter shows that every national economy can have its own bundles of “clusters”. For example, in Italy, about 40% of exports fall to the share of a cluster of industries related to food, fashion or housing improvement.

In Sweden, more than 50% of all exports are exports of cluster products related to transportation and metallurgy. This means that the process of formation of international competition can be interpreted as the emergence and development of a system of relations in society that contribute to increasing its maturity and mastering the achievements of world civilization.

It should be noted that the problems of developing and implementing competitive strategies of the main producers of the world market, including Russian producers, remain understudied, although it is quite obvious that relying only on general theoretical approaches in order to solve this problem would be insufficient. It is necessary to take into account the very significant specificity of both the product and its market both in the whole world and in individual regions. Only such an approach will provide an opportunity to scientifically substantiate strategies for the development of the Russian market and formulate specific recommendations for its entry into the world market with competitive products.

Thus, the insufficient theoretical elaboration of the problem and the high practical importance of its solution for improving the efficiency of the Russian economy led to the choice of this research topic.

The aim of the research is to formulate a set of scientifically grounded measures to create conditions for the Russian producers to enter the world market with competitive products.

The object of research is the competition of the largest foreign and Russian manufacturers in the world market.

The subject of the study is a complex of economic relations that arise between the main producers of world production and the actors of the world market in the context of globalization of competition.

The theoretical and methodological basis of the work is: the principles of systematization, allowing to analyze the problems of competition in the world market and the equal participation in it of Russia on the basis of the use of innovative factors that correspond to world trends in world production; principles of dialectics, allowing to take into account the internal inconsistency of the object under study; structural and functional approach, which makes it possible to identify a complex system of links in the world production and sales of products in the context of globalization and toughening of competition.

Analysis of specific statistical data is carried out through traditional methods of economic and statistical analysis, graphical constructions, expert assessments.

An important part in substantiating the main provisions and conclusions in the work was taken by the works of domestic and foreign economists on the classical and modern theory of the world economy, international economic relations, international trade, international management and marketing; research of leading international economic organizations, scientific and expert centers on the problems of world trade of UNCTAD, WTO, IBRD, IMF, information published on official Internet sites of producers and in periodicals.

The information base of the research was the materials of universal, financial and specialized international economic organizations, as well as annual reports of the largest foreign and Russian manufacturers, consulting firms and information published on official Internet sites of producers of world production and subjects of the world market in periodicals.

Methods of economic and system analysis were used in the work. Applied research on this topic was used. To summarize the information received, the systemic and dialectical approach, the historical and expert methods of assessments and conclusions were applied.

M. Porter's theory of international competition is based on two principles: the branch principle and the principle of location (Porter, 2006; Porter, 2011). The implementation of the first principle means the application of the concept of the five sectoral competitive forces, the value chain to the sphere of international business, and the implementation of the second principle finds its embodiment in his concept of “rhombus” of competitive country determinants (Prosvetov, 2012).

Globalization of international business is manifested in the fact that there is a transition from national industries to global sectors of the economy (Tapscott & Williams, 2013). This transition gives global competition a global character.

In the space of interstate business interaction, the intensity and nature of the activity of M. Porter's five competitive forces, which describe the competitive structure of the industry, are manifested in various forms of sectoral international competition (Supyan, 2012).

Forms of international competition in different industries vary significantly. By the degree of globalization of forms of international industry competition, all sectors can be ranked from the lowest one – “multidomestic”, to the highest one – global.

The “multi-national” form is, as it were, a set of the same industries (each within its own country), and competition in each country or a small group of countries, in fact, takes place independently.

Distinctive features of the competitive structure of the multi-national industry are:

For example: many types of trade, food production, wholesale, life insurance, savings banks, the production of simple metal products.

In the global industry, competition takes place on a truly global basis, i.e. competing firms:

Global competition takes place in such industries as the production of civil aircraft, television sets, semiconductor devices, copying equipment, household appliances, cars and watches, mobile phones. In the global industry, there is an intensification of intra-industry competition, which acquires an international and global character: firms willy-nilly have to compete in the international market in order to gain or not to lose a competitive advantage in the most important segments of the industry (Makaliz, 2014).

The globalization of industries intensified after the Second World War. Currently, many industries are in a transition from a “multi-national” to a global form, so the development of global competitive strategies is very important for firms in many countries.

A global competitive strategy is a competitive strategy in which the firm:

The single approach that is contained and implemented by the global strategy is as follows:

First, in the development of the strategy, the main issue is the placement of different links in the value chain (basic and auxiliary activities) in the space of interstate business interaction and ensuring its work so that it is possible to sell the company's goods and conduct business around the world.

Secondly, the practical implementation of the global strategy necessarily means the use of two distinct and complementary methods by which the firm can achieve a competitive advantage or compensate for various disadvantages due to conditions in a particular country (Brandenburger & Neilbaff, 2012).

The first method is the configuration of the business: the most advantageous location of different types of core and auxiliary activities of the value chain in different countries in order to best serve the world market, extract and implement competitive advantages.

The second method is the coordination of globally distributed business links of the company, i.e. coordination (coordination) of a global firm of activities scattered around the world of its branches and other units.

For example, the placement of links in the value chain directly related to the buyer (marketing, distribution and after-sales service) is usually tied to the placement of the buyer. In addition, the location of the buyer can be tied and the placement of other activities due to high transportation costs or the need for close interaction with the buyer. On the contrary, such activities as the production of raw materials, components, semi-finished products, etc., as well as auxiliary activities (development or acquisition of technology, R & D, etc.) can be located independently of the client's location – this activity can be performed anywhere.

When carrying out the configuration, it is necessary to answer the question: In which and in how many countries does each type of activity that is part of the value chain be carried out?

For example, do Ford companies produce cars at one large plant in the US or build additional factories in Western Europe and Russia?

Coordination requires an answer to the question: How is the dispersed activity coordinated (i.e., activities carried out in different countries)? For example, do different countries use the same brand and sales tactics, or does each branch use its own brand and tactics adapted to local conditions?

The answer to the first question allows us to define and implement a specific type of configuration. The practical answer to the second question is to implement such aspects of global coordination between the elements of the chosen business configuration in the interstate (global) space, as information exchange; distribution of rights and responsibilities between units; coordination of efforts of the firm's divisions within a transnational corporate governance system.

There are two main types of business configuration: concentration of activities and dispersal of activities. The main motive and reason for the firm to choose one or another type of configuration is the possibility of obtaining stable competitive advantages and neutralizing disadvantageous moments from the conditions of the home country and the host country.

The first type of configuration means the concentration of a significant part of the core and ancillary activities of the value chain in a single country, with the subsequent export of finished products or parts overseas.

The main reasons for the concentration of activities are:

A concentrated, or export-based, business configuration is typical of industries such as aircraft construction, heavy engineering, and the production of structural materials.

The second type of configuration means the dispersal of the main and auxiliary activities of the value chain in different countries and regions of the world. The main instrument for practical implementation of dispersal is direct foreign investment, which is a distinctive feature of this type of business configuration.

The main reasons for the dispersal of activity are (Filosofova & Bykov, 2014):

A dispersed configuration of business using large direct foreign investments is characteristic for such industries as the production of packaged consumer goods, the production and supply of cars, medical care, telecommunications and many types of services.

The global firm, implementing its global strategy through configuration and coordination, discovers and actively uses the two main specific sources of its competitive advantage:

Competitive advantages from the location of activities are the ability of a global firm to distribute different types of activities between countries, depending on where it is preferable to implement a particular species.

At the same time, the main reasons for placing an activity in one country or another are:

In addition, competitive advantages based on the location of activities in a particular country stem either from the home country of the firm, or from other (host) countries in which the firm operates.

The global firm, first, seeks to make use of the advantages gained in the home country to penetrate into foreign markets in the host countries (Grigoriev, 2012); second, it applies the benefits obtained from performing certain activities abroad, for strengthening of advantages or compensation of unprofitable moments in the country of basing. Due to this cross-application of advantages from the home country and from the host countries, the competitive advantage of accommodation is significantly enhanced and becomes global (Veselovsky, 2013).

Competitive advantages based on the structure of the firm, i.e. on the system for organizing the implementation of the various activities of the value chain around the world, stem from the total volume of the firm's trade, the speed at which technology and products are mastered at all of the firm's enterprises around the world, the firm's ability to coordinate activities at home and abroad and are independent of location.

Any firm, entering the path of international business to succeed in global competition and ensure sustainable competitiveness, must rely on a system of global competitive advantage.

However, the company needs to form such a system.

First, the firm must achieve a certain competitive advantage in its home country, sufficient to enter foreign markets.

Secondly, the firm must learn to create and take advantage of the location of activities and the structure of the organization of conducting its business around the world.

Thirdly, it must be able to combine the advantages achieved at home with the advantages of locating certain activities in other countries and the company's system of activities around the world.

As a result, these two additional advantages of the external world, combined with the achieved “houses” make the latter more stable, and at the same time compensate for non-winning moments in the home country.

Thus, the advantages of different sources mutually reinforce and form a system of the company's global competitive advantage.

Conclusion: The combination of benefits created by the configuration and coordination methods from:

from the organization of the company's global activities (structure), the company forms a system of the company's global competitive advantage, which ensures the stable international (global) competitiveness of the firm.

4.6. Determinants of Competitive Advantage of Countries and Regions

Today, the globalization of competition has become a recognized fact, the focus has been on the advantages of the structure of the firm and the location of activities in other countries.

However, the competitive advantages of firms resulting from the conditions in the home country (the cradle of the firm) are important for the formation of a system of global competitive advantage and sustainable international competitiveness of the company of a given country for several reasons.

First, the home country with its unique, specific features of the economy, culture, population, infrastructure, management, national values, history is the platform for the company's global strategy aimed at combining the advantages achieved in the country with those that provide firm positions of the firm in the world.

Secondly, the presence in the country of the constantly supported favorable (or unfavorable) conditions and the corresponding incentives for generating a powerful flow of innovative processes plays a decisive role in achieving international competitiveness, both of firms and the country of their basing.

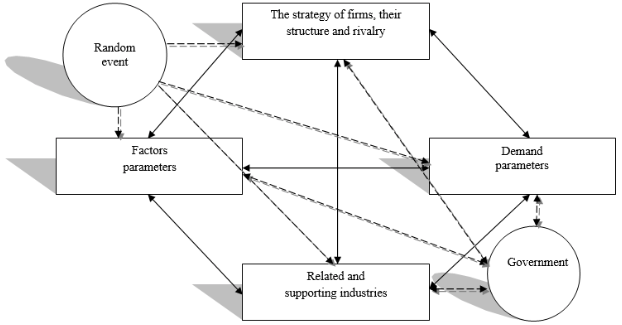

The competitive advantage of the country at the international level determines a certain set of determinants – M. Porter’s “national rhombus” (Figure 1).

Figure 1

Competitive advantage of the country at the international level and a set of its determining determinants

Source: (Porter M.E., 2006; Porter M., 2011).

It includes four key groups of properties of the country that form an environment in which local firms compete and develop competitive advantages that affect their international success:

There are two additional variables that significantly affect the situation in the country:

Random in this context are events that have little in common with the conditions for the development of the country's economy, and which are often beyond the influence of firms or the government. The most important events of this kind include inventions, major technological advances (breakthroughs), sharp changes in resource prices (for example, oil shock), surges in global and local demand, political decisions of local and foreign governments, wars and other force majeure circumstances. Random events can change the position of competing firms. They can negate the advantage of old competitors and create the potential for new firms that can replace old ones when they reach the necessary level of competitiveness in the new, changed conditions.

The state, according to Porter, should play the role of a kind of catalyst for competitiveness. The state, through its policy, can influence all four components of the national rhombus, but this influence can be either positive or negative. Therefore, it is extremely important to clearly formulate the priorities of state policy. The general recommendations are: promotion of all development, increased competition in the domestic market, stimulation of innovation production.

Recognition of the significant role and significance of the “country” conditions (determinants) that shape the competitiveness of companies is reflected in the regularly published ratings of the global competitiveness of countries by various authoritative international organizations. For example, the World Economic Forum's Global Competitiveness Report uses two approaches to competitiveness analysis.

The first approach focuses on the competitiveness of the economic growth of national economies (this approach was developed by J. Sachs and A. Warner and supplemented by J. MacArthur). The main objective of the calculated Growth Competitiveness Index (GCI) is to assess the ability of national economies to achieve sustainable development and is based on three groups of variables:

The second approach, based on the “national rhombus”, was proposed by M. Porter. The Microeconomic Competitiveness Index (MICI) uses microeconomic values of the existing production factors and opportunities in a given country. MICI takes into account two groups of variables (Kharchenko & Fomin, 2012):

In the context of globalization, the economy of any country is competitive to the extent that its regions are steadily and dynamically developing their attractiveness and their competitive advantages. In this regard, the role of the region as a place of basing competitive economic entities is significantly strengthened.

The competitiveness of the region is the productivity (efficiency) of the use of regional resources in comparison with other regions, which manifests itself in its development as the location of the most competitive economic entities and in the gross regional product (GRP) per capita.

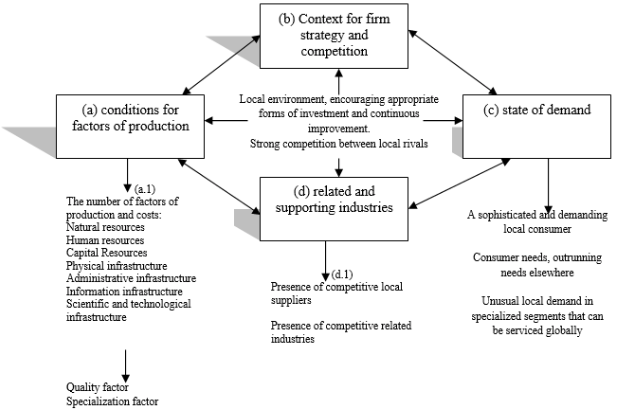

It is possible to identify and assess the main factors of the region's competitiveness with the help of a modified regional (local) model of M. Porter's “rhombus” (Porter, 2006; Porter, 2011), which includes: factors of production of a certain quantity, quality and specialization; sophisticated, demanding local consumer and unusual local demand that can be serviced globally; local competitive suppliers and related industries; a local business environment that encourages investment, continuous improvement, innovation and strong local competition (Figure 2).

Figure 2

Local competitive advantage factors

Source: Prepared by the authors.

Factors of production, shown in Figure 2, in order to increase their productivity must constantly improve in three areas: efficiency, quality and level of specialization.

The context of the strategy of firms and their rivalry depends, firstly, on: rules, incentives and norms governing the type and intensity of local competition. Secondly, it depends on the existing investment climate, defined by: the structure of the taxation system; system of corporate governance; policy in the labor market aimed at developing incentives for the workforce; effective legislation in the field of intellectual property and other spheres regulating business in the region.

Thirdly, it depends on regional policy, national to changing the nature of local competition: on rivalry based on low wages and cheap labor to competition based on innovation and constant development of key competencies of firms, their managers and personnel.

Local demand conditions depend, first, on the presence or appearance of sophisticated, demanding and even fastidious local consumers who are able to exert pressure on firms, forcing them to develop insight in relation to existing and future needs. Secondly, they depend on the presence of factors that force firms to move from counterfeit, low-quality products and services to conducting competition based on product differentiation and offering unique consumer values (Troitsky, 2014).

In the process of business globalization and the strengthening of international competition, the regional processes we examined (increasing the impact of the regional resource potential, creating demand conditions that stimulate the competitiveness of local producers, creating conditions for innovation and improving the quality of strategies and competition of firms operating in the region) find their embodiment in the formation of clusters of related firms, organizations, institutions, of major, related and supporting industries.

Clusters are geographically concentrated groups of interrelated companies, specialized suppliers, service providers, firms in relevant industries, as well as organizations associated with their activities (for example, universities, standardization agencies, and trade associations) in certain areas competing, but at the same time and leading joint work.

Clusters take different forms depending on their depth and complexity, but in most cases they consist of the following main elements:

First, the cluster core, composed of the leading company (companies) of the finished product; suppliers of specialized factors of production, components, machines, as well as services; key financial institutions and firms in related industries.

Second, firms that work with distribution channels or consumers; by-product manufacturers; specialized infrastructure providers; governmental and non-governmental organizations that provide special education, education, information, research, and technical support.

Third, power structures that have a significant impact on the functioning and development of the cluster.

Fourth, the chamber of commerce and industry, industry associations and other joint structures of the private sector that support the members of the cluster.

The internal structure of the cluster is networked; is a system of direct and indirect trust relationships between the participants of the cluster. The system of business and social-economic networks of the cluster makes it possible to significantly reduce the costs of production and distribution between its participants of important commercial, managerial and technological information. In addition, the cluster configuration of the regional economy, which has a network basis, creates a whole set of additional regional competitive advantages.

First, more effective interaction of the four facets of the “rhombus” is ensured, leading to a higher level of regional attractiveness and competitiveness.

Secondly, complementarity between sectors and sectors is developing; the dissemination of technologies, skills and information among the cluster participants is accelerating; the degree of understanding of the requirements of customers, consumers, customers for products and services of firms and organizations of the region is growing.

Thirdly, it is possible to conduct a constructive and effective dialogue between: related companies and their suppliers; power and business; science and business; universities and business.

Fourthly, economic policy focuses on enhancing regional attractiveness and competitiveness.

Fifthly, the specific tasks and functions of government and business in the improvement of clusters are clearly defined.

This set of additional regional competitive advantages provides: increasing the productivity of companies and organizations entering the cluster; formation and development of the ability to innovate and, thus, to increase productivity; stimulating the creation of new businesses that support innovation and expand the boundaries of the cluster.

1. According to the theory of international competition by M. Porter (Porter, 2006; Porter, 2011), the main factors determining competition in the industry are:

The value of each of the five forces of competition is determined by the structure of the industry, i.e. its main economic and technical characteristics. Each branch of the economy is unique and has its own structure.

2. The competitive advantage is divided into two main types: lower costs and differentiation of goods. The type of competitive advantage and the scope in which it is achieved can be combined into the concept of model strategies, i.e. completely different approaches to what is high in the industry.

3. M. Porter also proposed an original concept of the country's competitive advantage. The basis of this concept is the idea of a “national rhombus”, which reveals four properties (non-price determinants) of the country that form the competitive environment in which the firms of the country operate; its components which strengthen or weaken the potential level of competitive advantage of firms of this country.

Each separate determinant affects all others. So, the great demand for the firm's products does not in itself give it a competitive advantage, if the acuteness of competition is insufficient, so that the firm takes this demand into consideration. In addition, advantages in one determinant can create or enhance the advantages of others.

Adcock, D. (2000). Marketing Strategies for Competitive Advantage. Chichester: Wiley.

Brandenburger, A. & Neilbuff, B. (2012). Competitive cooperation in business. Moscow: Delo.

Chirkunov, O. (2012). State and competition. Moscow: New literary education.

Filosofova, T.G. & Bykov, V.A. (2014). Competition. Innovation. Competitiveness. Moscow: Unity-Dana.

Grigoriev, L. (2012). Competition and cooperation. Economic prospects of the Eastern Baltic. Moscow: Europe.

Kharchenko, S.G. & Fomin, B.B. (2012). International Cooperation on Problems of Risk Analysis. Moscow: Logos, Iris-Press.

Kirtsner, I. (2011). Competition and Entrepreneurship. Moscow: Sotsium.

Kuleshova, A.B. (2012). Competition in questions and answers. Moscow: TK VELBI, Prospect.

Makaliz, D. (2014). Business Economics. Competition, macro stability and globalization. Moscow: Binomial. Laboratory of Knowledge.

Marmashova, S.P. (2011). International competition. Moscow: Academy of Management under the President of the Republic of Belarus.

Ovchinnikov, V.V. (2011). Global competition. Moscow: Institute of Economic Strategies.

Ozhiganov, E.N. (2012). Innovative development policy. Global competition and strategic perspective of Russia. Moscow: Librocom.

Porter, M.E. (2006). Strategy and Society: The Link between Competitive Advantage and Corporate Social Responsibility. Harvard Business Review.

Porter, M.E. (2011). International competition. Competitive advantages of countries. Moscow: International relationships.

Prosvetov, G.I. (2012). Competition. Tasks and solutions. Moscow: Alfa-Press.

Reback, G. (2009). Free the Market! Why Only Government Can Keep the Marketplace Competitive. N.Y.: Portfolio.

Supyan, V.B. (2012). Leadership and competition in the world system: Russia and the United States. Under the general editorship. Moscow: Krassand.

Tapscott, D. & Williams, A.D. (2013). Wikinomics. How mass cooperation changes everything. Moscow: Best Business Books.

Troitsky, E. (2014). Strengthening the Russian world and competition. Return of compatriots. Moscow: Granitsa-Moskva.

Varady, T. (1999). The emergence of competition law in (former) socialist countries. American journal of comparative law, 47, 229-276.

Veselovsky, S.S. (2013). Multilateral cooperation in the fight against transnational terrorism. Moscow: Navona.

Wright, J.D. (2006). Antitrust Law and Competition for. Distribution. Yale Journal on Regulation, 23(2), 169-208.

1. Kuban State Technological University, Krasnodar, Russia

2. Institute of World Civilizations, Moscow, Russia

3. Pyatigorsk Medical Pharmaceutical Institute - branch of Volgograd State Medical University, Pyatigorsk, Russia

4. Peoples' Friendship University of Russia (RUDN University), Moscow, Russia; Financial University under the Government of the Russian Federation, Moscow, Russia, E-mail: nvmali@mail.ru

5. Don State Technical University, Rostov-on-Don, Russia