Vol. 39 (Number 28) Year 2018 • Page 12

Yulia N. MATUSHKINA 1; Oleg P. MATUSHKIN 2; Evgeny V. KOSOLAPOV 3; Olga V. KOSTENKO 4; Nadezhda V. PALESHEVA 5

Received: 12/02/2018 • Approved: 25/03/2018

ABSTRACT: In the conditions of limitation of sources of financing, the issue of investment portfolio selection is very topical. In such cases, managerial decision making requires a complex evaluation of economic effectiveness of investments which has to take into account the interests of investors on the basis of assessment of expedience of investments and the interests of companies. Synergetic evaluation of effectiveness of alternative investment projects is necessary – it supposes determining the advantages of a certain project not by one criterion but by their totality, as each of them has its drawbacks. The authors offer and approbate the methodology of evaluation of economic effectiveness of the projects based on system analysis of hierarchical structures, which ensures complete scientific substantiation of investment decision making. Based on the offered methodology, a computer program is developed, which allows evaluating projects according to several criteria. |

RESUMEN: En las condiciones de limitación de las fuentes de financiación, la selección de carteras de inversión es de reciente data. En tales casos, la toma de decisiones gerenciales requiere una evaluación compleja de la efectividad económica de las inversiones que debe tener en cuenta los intereses de los inversores sobre la base de la evaluación de la conveniencia de inversiones e intereses de las empresas. La evaluación sinérgica de la efectividad de los proyectos de inversión alternativos es necesaria: supone determinar las ventajas de un determinado proyecto no por un criterio sino por su totalidad, ya que cada uno de ellos tiene sus inconvenientes. Los autores ofrecen y abordan la metodología de evaluación de la efectividad económica de los proyectos basada en el análisis de sistemas de estructuras jerárquicas, lo que garantiza una fundamentación científica completa de la toma de decisiones de inversión. Con base en la metodología ofrecida, se desarrolla un programa informático que permite evaluar proyectos de acuerdo con varios criterios. |

The problems of investing in economy have always been in the focus of economic science due to the fact that investments influence the foundations of economic activities and determine the process of economic growth on the whole. In the modern conditions, they are the most important means of provision of conditions for overcoming the current economic crisis, structural shifts in national economy, provision of technical progress, and increase of qualitative indicators of economic activities at the micro- and macro-levels. Activation of investment process is one of the most efficient mechanisms of socio – economic transformations. At that, the necessity for conducting complex evaluation of economic effectiveness of investment projects comes to the foreground – and it is possible only on the basis of applying the methodology of multicriteria optimization. Russian economic science pays a lot of attention to these issues. However, there has been a drawback in methodologies of quantitative evaluation of economic effectiveness of investment projects on the basis of multicriteria optimization. The main reason for this is complexity of complex evaluation of effectiveness of investments at various levels – corporate, sectorial, regional, and state. This article contributes into the Russia and foreign science, as it solves this problem.

The offered methodology allows:

- conducting targeted financing of projects, providing return of assets and their effective use;

- evaluating the risk level and choosing the most expedient project;

- making timely managerial decisions during implementation of investment projects on the basis of the models of planning of effectiveness indicators.

This methodology simplifies the process of investment decision making and reduces the risk by means of obtaining objective information.

Economic effectiveness of investment projects is a complex economic category. Theory and practice of estimate activities includes a lot of various methods and practical means of evaluation of projects’s effectiveness, which are systematized and presented in Table 1.

Table 1

Development of the methods of evaluation of investment projects’ economic effectiveness

Period |

Normative document / Approach |

Methods |

Drawbacks/ Advantages |

Centralized economy |

Methods of determining the effectiveness of capital investments |

Minimization of expenditures, coefficient of effectiveness, return period |

Alternative expenditures and inflation are not taken into account. Amortization is treated as a part of expenditures. |

Economy of the transitional period |

Methodological recommendations for evaluation of effectiveness of investment projects |

Net income: net present value; internal norm of profitability; return period |

Single-criterial approach to evaluation of economic effectiveness of projects. |

Modern period |

Synergetic approach |

Methods of multicriteria optimization |

Multicriterial approach to evaluation of projects |

In the modern conditions, it is necessary to apply synergetic approach during evaluation of investment projects. At that, creation of modern methodologies for selecting the best investment projects is peculiar for consideration of the synergetic component of the effect. Synergetic effect is predetermined by collective evaluation and collective influence on the final result of all indicators, calculated with the help of various methods. This approach is peculiar for calculating several criteria and accounting of their joint influence on economic effectiveness of investment projects.

One of the means of implementing the methodology of synergy could be illustrated with the methodology of selecting the economically expedient investment project on the basis of multicriteria optimization. The result of calculation for any method of evaluation of economic effectiveness of a project can reflect only one positive aspect. The numerical values of various criteria for each alternative projects could differ and even be in a conflict. In such situation, there’s a need for synergetic (complex) evaluation of effectiveness of alternative investment projects, which supposes determining the advantages of a certain project not by one criterion but by their totality. Such complex evaluation of business project could be obtained only on the basis of application of the methodology of multicriteria optimization.

The purpose of the research is to develop and substantiate the use of the main methods of multicriteria optimization during evaluation of economic effectiveness of investment projects on the basis of synergetic approach. The research object is investment projects that are implemented in Kirov Oblast, Russia.

For solving theoretical and applied tasks, the methods of systemic and comparative analysis, multicriteria optimization, economic and mathematical modeling and forecasting, and decision making in the conditions of risk and uncertainty, as well as the method experiment planning were used. Processing and analysis of the information were conducted with the use of the following programs: Excel, Project Expert, and Statgraphics Plus.

Recently there has been increased interest from investment managers, planners, economist, entrepreneurs, and business evaluator to the problem of practical use of the methods of multicriterial (vector) optimization during solving the tasks in the sphere of management of production, finances, and investments. There are a lot of publications on the aspects of this complex and topical problem.

The tasks of multicriterial optimization attract a lot of attention of scholars and practitioners. The main results in this direction are related to the works of V.B. Germeyer [7], N.N. Moiseev [24], S.V. Emelyanov [10], V.S. Mikhalevich [23], P.S. Krasnoshchekov [13], O.I. Larichev [14], and their followers.

There are several approaches to solving multicriterial tasks of optimization. Let us consider some of them.

1. Development within the abstract model of selection of multi-scale extreme mechanisms that allow for rational choice according to vector criterion (M.A. Aizerman [1], S.V. Emelyanov, I.M. Makarov, B.A. Berezovsky, et al.).

2. Application of the theory of usefulness for multicriterial selection of alternative from discrete multitude in the conditions of risk and uncertainty (R.S. Fishburn, A.N. Borisov, V.E. Zhukovin, et al.).

3. Based on a certain system of requirements set to the optimal solution, formalized in the form of totality of axioms, a scheme of multicriterial choice is built as a consequence of this system of axioms (V.V. Podinovsky, E.I. Vilkas, et al.).

4. Bringing the multicriterial task of selection to scalar optimization with the help of a certain contraction of vector criterion (Y.B. Germeyer, P.S. Krasnoshchekov, U.G. Evtushenko, R. Shtoyer, J.L. Cohon).

5. Development of man-machine procedures of solving multicriterial tasks of optimization in the interactive regime (V.L. Emelyanov, A. Joffrion, R. Shtoyer).

6. Creation of the sphere of compromises and the corresponding multitude of Pareto optimal solutions for certain classes of multicriterial tasks of optimization (J.L. Cohon, В. Villareal, М.Н. Karwan, S. Zionts).

Stimulation of development and expansion of the scale of use of methods of vector optimization was predetermined by the requirement of practical implementation of the systemic approach to solving the tasks in the system of investment planning, as well as the necessity for large increase as a result of economic effectiveness of production and sale of products and increase of competitive positions of a company at the target market.

Economic expedience of transition from single-purpose approach to multi-purpose approach is predetermined by the fact that the results of implementation of solutions of investment tasks into practical activities into companies that are received in the second case are more preferable.

At that, the following weakly studied and insufficiently researched issues of implementation of multi-purpose approach are very topical.

The present methodologies of evaluation offer the methods of calculations on the basis of which it is possible to select the most effective option for a certain economic indicator. At that, each of the known methods of evaluation of economic effectiveness is peculiar for a certain list of advantages and drawbacks. Thus, any of the recommended methods of calculations can provide only a one-sided evaluation of effectiveness of alternative projects.

The article offers a method of evaluation of economic effectiveness of investment projects on the basis of multicriteria optimization from the position of the leading criterion. The conceptual and methodological basis of accounting of information that is set in each private criteria and determining the weight of criteria should consist of provision of systemic analysis of hierarchical structures based on the method of own vector and the principle of hierarchical composition, which ensures complete scientific substantiation of the rules of investment decision making with a lot of criteria.

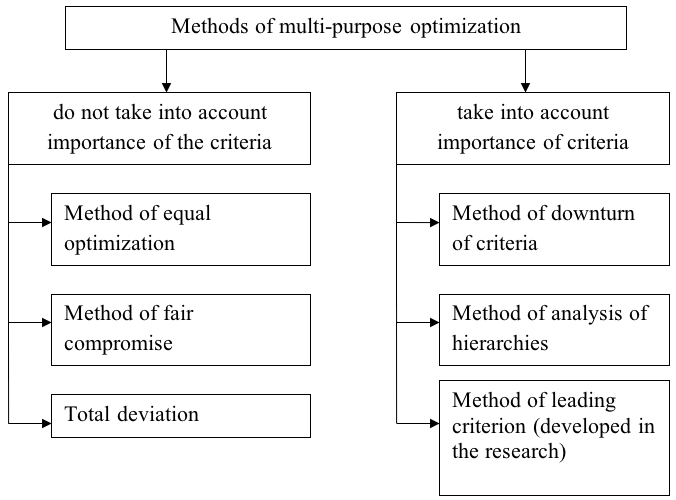

The methods of multicriteria optimization, applied for this purpose, should be classified in the following way (Figure 1). Let us view these methods by the example of 24 investment projects, presented in the form of IP (IP1, IP2, IP3, IP4, IP5….), from the position of three indicators of effectiveness (NPV, IRR, DPP). It was determined that the results of calculations according to the methods that do not take into account the importance of criteria coincide. This is explained by the fact that criteria of optimality of NPV, IRR, and DPP, which have different economic nature and different measuring units, normalize – i.e., are brought down to dimensionless values.

Figure 1

Classification of the methods of multicriteria optimization

The method of downturn of criteria is different from the previous methods as it takes into account the “weight” of criteria. However, the results of this method cannot be considered authentic, as normalization of criteria takes place only as to the most optimal one. The method of analysis of hierarchies is free from drawbacks of the previous methods – but, in our opinion, it is not expedient to use it for evaluation of economic effectiveness of investment projects, as criteria are expressed in absolute and relative measuring units – so there’s no necessity to use the Saaty Scale.

Thus, we see the necessity of improving the evaluation of investment projects on the basis of several criteria of effectiveness in view of their weight. The offered methodology of evaluation of effectiveness from the position of “leading criterion” allows taking into account and eliminating the most significant drawbacks of the above methods.

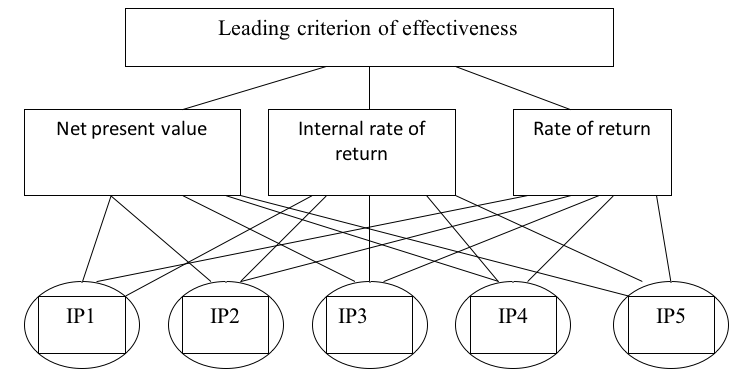

Let us structure the problem of evaluation in the form of the following hierarchy (Figure 2).

Figure 2

Hierarchy of investment projects evaluation.

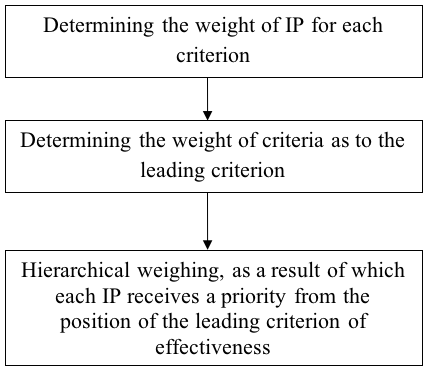

A person who makes decisions (PMD) faces the task of determining the investment project (IP) that is effective in view of all three criteria – i.e., from the position of the leading criterion of effectiveness. This task is solved in three stages (Figure 3).

Figure 3

Stages of the method of leading criterion

At the first stage, matrices of paired comparisons of investment projects as to private criteria of NPV, IRR, PP are built (Table 3).

Table 3

Matrix of paired coincidences as to NPV.

Matrix |

ip1 |

ip2 |

ip3 |

ip4 |

ip5 |

ip1 |

1.000 |

0.750 |

0.500 |

0.500 |

0.500 |

ip2 |

1.333 |

1.000 |

0.667 |

0.667 |

0.667 |

ip3 |

2.000 |

1.500 |

1.000 |

1.000 |

1.000 |

ip4 |

2.000 |

1.500 |

1.000 |

1.000 |

1.000 |

ip5 |

2.000 |

1.500 |

1.000 |

1.000 |

1.000 |

The next step is determination of own vectors that correspond to the maximum own values of matrices. Numerical values of the components of own vectors determine the relative priority of investment projects as to the corresponding private criteria.

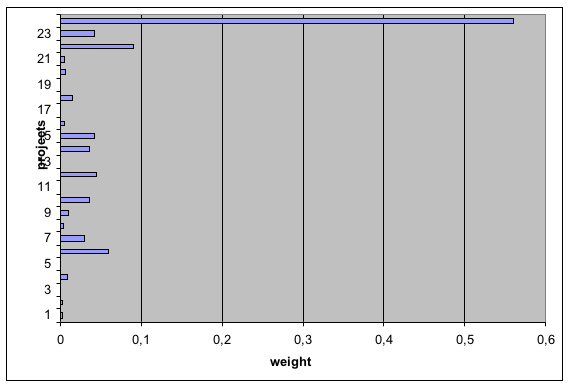

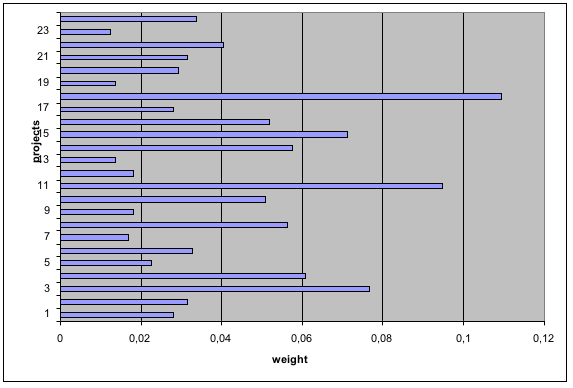

The results of calculations are presented in Figures 4, 5, and 6.

Figure 4

Priority of investment projects as to NPV.

Thus, Figure 4 shows that as to the NPV criterion, the most preferable project is project 24. Its priority (weight) equals 0.559984.

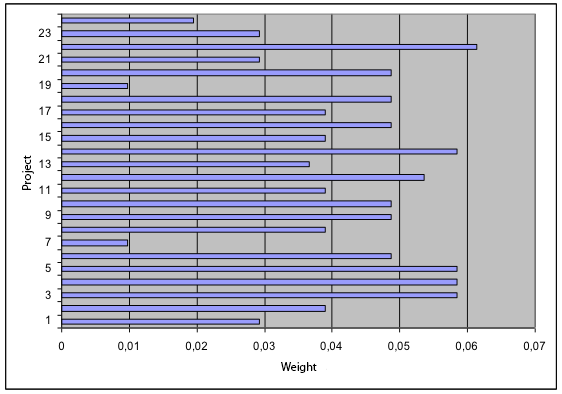

Figure 5

Priority of investment projects as to IRR.

According to the criterion IRR (Figure 5), the top-priority project is project 18. Its priority (weight) equals 0.109357.

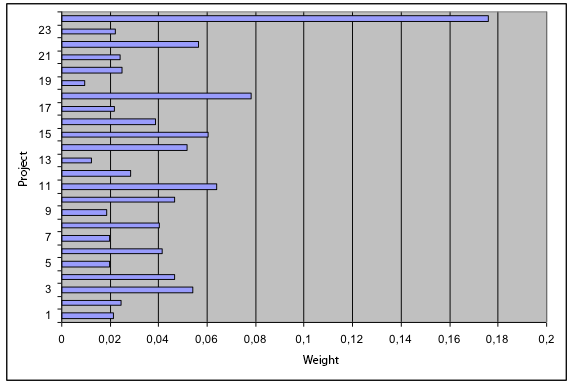

Figure 6

Priority of investment projects as to DPP.

As to the criterion of discounted pay-back period (Figure 11), project 22 has the largest weight. Its priority (weight) equals 0.0614334.

At that, from the point of view of one criterion of effectiveness, it is impossible to choose the most preferable project, so it is necessary to use them in combination – which allows taking into account the information set in each private criterion and provides the complex evaluation of IP. For this, we use the expert opinions as to the importance of “weight” of private criteria.

At the second stage, we build the matrix of paired comparisons of private criteria from the point of view of this situation with decision making, or from the position of the leading criterion of effectiveness (Table 4).

Table 4

The matrix of paired comparisons of private criteria of effectiveness.

|

NPV |

IRR |

DPP |

Wк |

NPV |

1.00 |

0.43 |

3.00 |

0.273 |

IRR |

2.33 |

1.00 |

7.00 |

0.636 |

DPP |

0.33 |

0.14 |

1.00 |

0.091 |

Therefore, IRR criterion is the most significant. Its “weight” constitutes 0.636. Then come NPV (weight – 0.273) and PP (weight – 0.091).

The final stage is synthesis (“hierarchical weighing”), as a result of which IP are evaluated from the point of view of the leading criterion of effectiveness:

W(IP1)=W(IP1/K1)∙W(K1)+W(IP1/K2)∙W(K2)+W(IP1/K3)∙W(K3);

W(IP2)=W(IP2/K1)∙W(K1)+W(IP2/K2)∙W(K2)+W(IP2/K3)∙W(K3);

…………………………………………………………………………...;

W(IP24)=W(IP24/K1)∙W(K1)+W(IP24/K2)∙W(K2)+W(IP24/K3)∙W(K3).

Formally, this stage of synthesis could be presented in the form of product of the matrix of priorities, which columns are vector of priorities of IP as to the viewed private criteria, and the vector – column of importance (“weight”) of criteria as to the leading criterion of effectiveness. Let us form the matrix of priorities (Table 3) and multiply it by the vector – column of priorities of criteria (Table 4). As a result, we have vector – column, which could be presented in the graphic form (Figure 7).

Figure 7

Priority of projects as to all criteria

Thus, project 24 is considered to be most effective – it had the largest weight as to the NPV criterion. Though IRR was the leading criterion, leadership of this project preserved. Second position is occupied by project 18, which had the largest priority as to the IRR criterion. The third position is occupied by project 11, which was ranked 2nd as to the IRR criterion. Project 22 was ranked fifth, despite being the leader as to DРР.

The performed research shows that it is important to take into account the whole multitude of criteria. The results of ranking of projects as to the methods of multicriteria optimization are presented in Table 5. Distribution of investment projects according to the offered method differs from other methods (for certain projects, the difference is very large). The results of the method of turndown of criteria cannot be considered authentic, as normalization of criteria takes place as to the most optimal one – while in the offered method the criteria are compared by enumeration.

Table 5

Result of evaluation of effectiveness of investment projects with various methods

Organization |

Method of equal optimization |

Method of fair compromise |

Total deviation |

Method of turndown of criteria |

Method of leading criterion |

EcoBioProduct CJSC |

1 |

1 |

1 |

1 |

2 |

Kare Len LLC |

2 |

2 |

2 |

3 |

6 |

Novaya Vyatka OJSC |

3 |

3 |

3 |

5 |

4 |

Vakhrushi Yuft LLC |

4 |

4 |

4 |

6 |

9 |

Biokhimzavod |

5 |

5 |

5 |

8 |

5 |

Pochvomash OJSC |

6 |

6 |

6 |

4 |

3 |

NMZ-2 |

7 |

7 |

7 |

2 |

1 |

Novaya Vyatka OJSC |

8 |

8 |

8 |

7 |

7 |

1st of May OJSC |

9 |

9 |

9 |

9 |

8 |

Silikat OJSC |

10 |

10 |

10 |

10 |

12 |

Lepse OJSC |

11 |

11 |

11 |

12 |

10 |

Korvalol |

12 |

12 |

12 |

13 |

21 |

Sosnovsky Plant OJSC |

13 |

13 |

13 |

11 |

11 |

Kirovo Chepetsk Chemical Factory OJSC |

14 |

14 |

14 |

15 |

13 |

Krasnogorsky CJSC |

15 |

15 |

15 |

14 |

14 |

Poleko OJSC |

16 |

16 |

16 |

17 |

22 |

Tandem LLC |

17 |

17 |

17 |

16 |

15 |

Vyatka OJSC |

18 |

18 |

18 |

18 |

18 |

KirovInterTrans OJSC |

19 |

19 |

19 |

21 |

23 |

Krasnogorsky CJSC |

20 |

20 |

20 |

19 |

16 |

Avitek |

21 |

21 |

21 |

20 |

19 |

Demetra |

22 |

22 |

22 |

22 |

17 |

Krasny Yakor OJSC |

23 |

23 |

23 |

23 |

20 |

Vyatka Fur Farm CJSC |

24 |

24 |

24 |

24 |

24 |

The offered method’s drawback is its labor intensity. We developed a program which allows evaluating the effectiveness of investment projects as to the several criteria and ranking the projects from the positions of the leading criterion. The results of calculations are presented graphically. The number of projects that could be processed by the program is not limited.

Let us view the order of work with the program:

1) quantitative values of the first criterion of effectiveness;

2) the program forms the matrix of paired comparisons for this criterion;

3) automatic calculation of “weight” of each projects for the criterion;

4) formation and analysis of matrices for other criteria;

5) the program conducts hierarchical weighing, as a result of which each project receives priority from the position of the leading criterion of effectiveness.

Novelty of this development has been confirmed by the Center of information technologies and systems of executive power bodies (inventory No. 50200901150 dated November 23, 2009), the Institute of scientific information and monitoring of development of sciences on education, and the Unified fund of electronic resources “Science and education” (Registration of program No. 15066, Moscow, December 8, 2009).

Thus, this computer program is a new technical solution in the sphere of evaluation of effectiveness of investment projects. It allows conducting evaluation as to several criteria and ranking the projects from the position of the leading criterion. The results of calculations are presented graphically, and the number of projects that could be processes in not limited. Multi-purpose optimization allows determining the effectiveness on the basis of synergetic approach, which ensures full scientific substantiation of investment decision making with multiple criteria. The program can be used by managers and specialists of companies of various spheres of national economy for studying project investment portfolios and at the regional level – during selection of projects for state support.

10. Emelyanov S.V., Nappelbaum E.L. Logic of rational choice // Technical cybernetics. – М.: VINITI, 1977. – V.8. P. 5-101.

11. Zolotogorov V.G. Investment projects: Study guide for universities.- Minsk: Higher school, 2001. – 264 p.

11. Kalugin V.А. Express evaluation of investment offer //Financial management.- 2006.- No.3.- P.73-85.

12. Knyazevа Е.N. Synergy as a new ideology: dialog with I. Prigozhin // Issues of philosophy.- 1992.- No.12.

13. Krasnoshchekov P.S. Mathematical models in research of operations. – М.: Nauka, 1984.

14. Larichev О.I. Theory and methods of decision making. – М.: Logos, 2000.

15. Lozhnikova А.V. Investment mechanisms in real economy.- М.: МZ-Press, 2001.- 176 p.

16. Lvov Y.А. Economic and mathematical methods and models: Study guide / LIEI. – L., 1980.

17. Matushkina Y.N. Modeling of indicators of economic effectiveness of investment project in the conditions of risk. [Text] / Y.N. Matushkina // Scientific and practical journal “Integral” - 2010 - No. 1, p. 48-49

18. Matushkina Y.N. State support for investment activities in Kirov Oblast [Text] / Y.N. Matushkina // Materials of the regional scientific and practical conference “Actual problems of socio-economic development of Russia”. Kirov: branch of St. Petersburg Institute of International Trade, Economics and Law, 2009.

19. Matushkina Y.N., Doronkina L.N. Evaluation of effectiveness of investment projects on the basis of multicriteria optimization. [Text] / Y.N. Matushkina, L.N. Doronkina // Scientific and practical journal “Integral” - 2009 - No. 6, p. 52-53

20. Matushkina Y.N. Quantitative evaluation of risk of investment projects [Text] / Y.N. Matushkina // Materials of the regional scientific and practical conference “Actual problems of socio-economic development of Russia”. Kirov: branch of St. Petersburg Institute of International Trade, Economics and Law, 2007.

21. Matushkina Y.N. Evaluation of investment projects on the basis of the synergy principles [Text] / Y.N. Matushkina // Actual issues of economic science: methodology and theory of provision of competitiveness of entrepreneurial structures: Collection of scientific works. – Kirov: Vyatka SAEA, 2007.

22. Mertens А.V. Investments: Lectures on modern financial theory. – Kyiv: Kyiv Investment Agency, 1997.

23. Mikhalevich V.S., Volkovich V.L. Calculation methods of research and design of complex systems. – М.: Nauka, 1982. – 286 p.

24. Moiseev N.N. Mathematical tasks of system analysis. М.: Nauka, 1981. – 156 p.

25. Rimer М.I., Kasatov А.D., Matienko N.N. Economic evaluation of investments. 2nd edition / Edited by M.I. Rimer. – SPb.: Piter, 2008. – 480 p.

26. Trifonov Y.V., Plekhanova А.F., Yurlov F.F. Selection of effective solutions in economy in the conditions of uncertainty. – Nizhny Novgorod: NNSU, 1998.

27. Haimann D.N. Modern micro-economics: analysis and application. In 2 V. – М.: Finances and statistics, 1992.

28. Chetyrkin Е.М. Financial analysis of production investments. – М.: Delo, 1998.

29. Sheremet А.D., Saifullin R.S. Methodology of financial analysis. – М.: INFRA-М, 1995. – 176 p.

30. Shchurov B.V., Gotin А.Е. Analysis of methodology of selection of investment projects on the basis of the methods of multicriteria optimization //Economic analysis: theory and practice.- 2006. - No. 8. – P.2-7.

1. Vyatka State Agricultural Academy, Russia and Vyatka State University, Kirov, Russia. e-mail: L2903@yandex.ru

2. Vyatka State University, Kirov, Russia

3. Vyatka State Agricultural Academy, Russia and Vyatka State University, Kirov, Russia

4. Vyatka State Agricultural Academy, Russia.

5. Vyatka State University, Kirov, Russia