Vol. 38 (Nº 49) Year 2017. Page 16

Yan Gennadievich SHTEFAN 1; Liliya Aleksandrovna ZIMAKOVA 2; Maria Aramovna VAKHRUSHINA 3; Victoria Borisovna MALITSKAYA 4; Maria Borisovna CHIRKOVA 5

Received: 12/06/2017 • Approved: 05/07/2017

ABSTRACT: In the present context, pricing issues should be considered both from the standpoint of meeting the needs of consumers and from the standpoint of business performance. The authors have presented the stages of economic substantiation analysis and modeling for making decisions on the price strategy as part of management accounting in the article. The meat processing industry has been chosen as an object of research. The speed of making competent decisions depends on the quality and speed of the information analysis, therefore one of the important requirements to the modern management accounting system is collection of information, both historical and prognostic, that would be sufficient for managers of different levels, as well as the active use of mathematical tools. This article describes 5 consecutive stages of collection of external and internal information, suggests ways to process it and formulas to build predictive models, through which companies can be able to speed up the process of obtaining information to determine pricing policy and improve the quality of economic substantiation for decisions made. |

RESUMEN: En el contexto actual, las cuestiones relativas a los precios deben considerarse tanto desde el punto de vista de las necesidades de los consumidores como desde el punto de vista del rendimiento empresarial. Los autores han presentado las etapas del análisis fundamentación económico y modelado para tomar decisiones sobre la estrategia de precios como parte de la contabilidad de gestión en el artículo. La industria cárnica ha sido escogida como objeto de investigación. La rapidez de la toma de decisiones competentes depende de la calidad y rapidez del análisis de la información, por lo que uno de los requisitos importantes para el sistema moderno de contabilidad de gestión es la recopilación de información, tanto histórica como pronóstica, que ser suficiente para los administradores de diferentes niveles, así como el uso activo de herramientas matemáticas. Este artículo describe 5 etapas consecutivas de recopilación de información externa e interna, sugiere maneras de procesarlo y formular modelos predictivos, a través de los cuales las empresas pueden acelerar el proceso de obtención de información para determinar política de precios y mejorar la calidad de la fundamentación económica para las decisiones tomadas. |

The speed of making competent decisions depends on the quality and speed of the information analysis, therefore one of the important requirements to the modern management accounting system is collection of internal and external information, both historical and prognostic, that would be sufficient for managers of different levels. Today, when the market is sufficiently saturated with meat products, the issues of making decisions on the production of high-quality products of the range that is in demand are important for all producers. At the same time, the problems of a proper approach to long-term and short-term pricing, which would take into consideration interests and capabilities of both consumers and producers, come to the fore. These decisions are made by company managers and employees of commercial departments, but their quality largely depends on the source information used, which is formed in the management accounting subsystem, the ways of its processing and the possibility of building predictive development models.

The core postulate of the contingency theory of P. Lawrence (Kuzmin, 2013) is the lack of a universal way to rule the organization, and as a consequence there is no single set of characteristics of the subsystem of management accounting information for all agents. Each economic agent has its own distinctive features: production, organizational, managerial, development strategies, as well as the number and extent of external factors. As a result, the situational and adaptive approaches to the formation of the management accounting information subsystem are the most actively developing today. The external environment has sufficiently significant influence on the functioning of the agents and determination of the optimal areas for their development. In the opinion of foreign researchers of subsystems of management accounting information – C. Drury (Drury, 2008), L.A. Gordon & V.G. Natayanan (Gordon, 1984), L. Mia & R.H. Chenhall (Mia, 1994), D. Morris (Chenhall, 1986) and some others, – the marketing field is more uncertain than production activity, while narrowly focused financial indicators that are formed on the basis of traditional accounts do not provide it with appropriate information.

According to M.A. Vakhrushina (Vakhrushina, 2013), D.V. Mikhailova (Mikhailova, 2014), I.G. Ushanov (Ushanov, 2014), V.V. Schneider (2014), L.V. Usatova, I.A. Shok and N.A. Kalutskaya (Usatova, 2015), the management accounting information subsystem that ensures decision-making in terms of pricing should allow to reduce the level of uncertainty by calculating the influence of external factors on pricing; predicting changes in prices taking into consideration the capabilities of consumers; determining the projected cost price of certain types of products.

Modern producers are focused on consumers; therefore, an important part of this process is to determine the factors that influence prices and the choice of the proper pricing policy. The need to focus the activities on long-term tasks requires changing approaches to collecting and predicting information of the external environment to determine the pricing policy.

At the first stage, factors that influenced pricing in the meat processing industry were identified and analyzed. Two sources of information were used during the research:

1) statistical data for the Russian Federation,

2) data of economic agents of the meat processing industry of the Belgorod region.

A standard statistical analysis of the per capita monetary incomes of the population was carried out, a trend equation was built, and a revenue forecast through to 2020 was built on their basis.

Based on these forecasts of the volume of production of commercial pork in the Russian Federation and information of the average option of the forecast of changes in headcount, the volume of average annual production of pork per capita (Cons) was calculated using the following formula:

Cons = S/N, (1)

where S was production volume,

N was average annual population

The second stage involved building the economic and mathematical model for the development of the price environment on the pork market based on multifactor correlation and regression analysis. This approach allowed to assess the degree of influence of each of the factors introduced in the model at the other factors fixed at the intermediate level on the resulting figure under study (prices of agricultural producers for pork).

The theoretical basis for building a model of the pork market was constituted by the works of Russian researching economists. The hypothesis about the influence of certain factors on the state of prices in the pork market was based on the researches of the Doctor of Economics, Professor of the Department of Economics of the Non-state educational institution of higher professional education Russian New University, K.G. Borodin (Borodin, 2015). The standard form of the equation for the development of the commodity market formed by the authors is as follows (2):

P = a0 + a1Inc + a2Cons = a0 + a1Inc + a2[S/N], (2)

where a0 is a constant term, a1, a2 (a2<0) are coefficients;

Inc is income per capita;

Cons is goods production per capita,

S is volume of production,

N is average annual population.

An important component of this stage is the correlation and regression analysis of actual values.

Building the forecast model and testing its significance suggest:

- calculation of the regression statistics of the model;

- estimation of the manifested reliability of the resulting figure dependence on the factors reflected in the model with the use of the variance analysis;

- estimation of variability determined by the effect of the variables under study and their interaction, with the calculation of the F-test.

The model presented and justified by calculations allowed to predict a change in the level of prices for products.

At the third stage, prices and competitive advantages were monitored, which included monitoring, evaluation and research of the trends of main competitors of the meat processing industry.

It is recommended to use the selling prices (ex VAT) as a basic criterion determining the value of a certain part of the dressing. As such, it is proposed to distribute the prime cost of the raw material that has undergone processing using formulas (3, 4):

where

(PC) is cost of processed raw materials (PC),

UPC is unit production cost,

Q is quantity of processed raw materials,

P is selling price of processed raw materials (ex VAT),

Praw is purchase price of raw materials (ex VAT),

u (units) is number of types of processed raw materials,

BPR is basic price ratio.

At the same time, it becomes possible to calculate the marginal revenue for each type of products, which in turn lays the foundation for modeling the production in order to reduce costs.

The fifth stage suggested conclusions and definition of a pricing policy on the basis of calculations made at the previous stages.

Results of theoretical studies were implemented in practice.

At the first stage, external factors influencing pricing were defined, their statistical analysis was carried out, and a forecast of the change in factors was compiled.

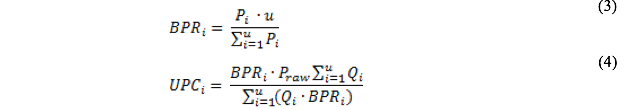

Based on the statistical data on the per capita income of the population, the chart presented in Figure 1 was built.

Figure 1

Weighted average income of the Russian population, rub./pers.

(Russian Statistical Yearbook 2016. Statistical Bulletin, 2016).

It reveals that per capita income in Russia sees a stable increasing trend; this is confirmed by the high index of reliability of approximation (R2 = 0.9969) and indicates a high degree of correspondence of the linear trend model to the source data.

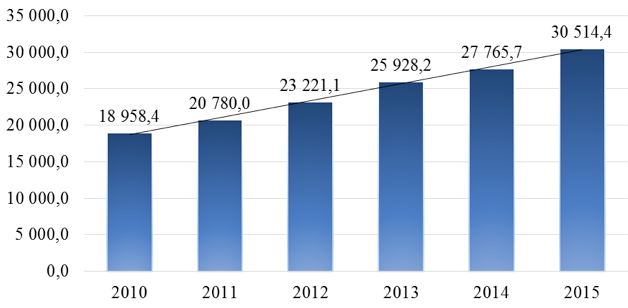

Based on the compiled trend equation (5):

Y = 2 327*X + 16 384, (5)

the forecast of the weighted average income of the Russian population was built, which was graphically represented in Figure 2.

Figure 2

Forecast of weighted average income of the Russian population, rub./pers.

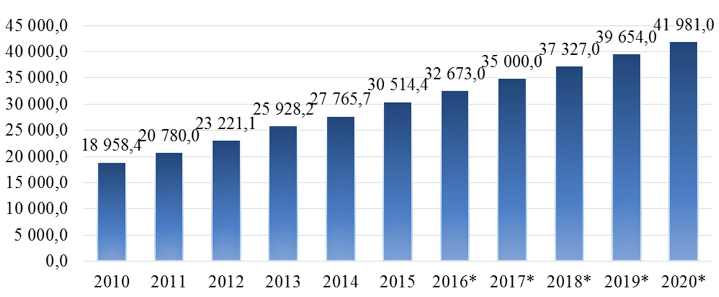

Volume of production of commercial pork in Russia is another important external factor; its dynamics and development forecast are presented in Figure 3.

Figure 3

Forecast of the volume of production of commercial pork in Russia, kg

(Russian Statistical Yearbook 2016. Statistical Bulletin, 2016).

The upward trend in volume indicators is due to gradual decrease in the share of private farm holdings, as well as to the program of accelerated import substitution.

Evaluation of the demographic situation in Russia, presented in Figure 4, was made on the basis of official data on the average option of the forecast of changes in Russian population.

Figure 4

Forecast of changes in population according to the average scenario of the situation d

evelopment, people. (Federal Service of State Statistics of the Russian Federation).

The forecast of the average annual pork production per capita shown in Figure 5 was calculated on the basis of indicators of forecasted growth in production volumes and population using formula (1).

Figure 5

Forecast of average annual pork production per capita in Russia, kg/pers.

At the second stage, a multifactorial correlation and regression analysis of actual values for 2010-2015 was carried out, based on the formula (2) and using the MS Excel analysis package, which allowed to form the regression equation (6):

P = 30,7331 + 0,0045 * Inc – 1,03282*Cons (6)

Following the results of the analysis, it was found that 78.44% (value of the coefficient of multiple determination) of price variation was explained by changes in per capita income, as well as by fluctuations in production per capita. Besides, since the calculated F-test was larger than the tabulated value (7.28 > 6.94), the explained variance was significantly larger than the unexplained variance, hence the model was significant. Therefore, the calculated model data can be used for predictive estimate.

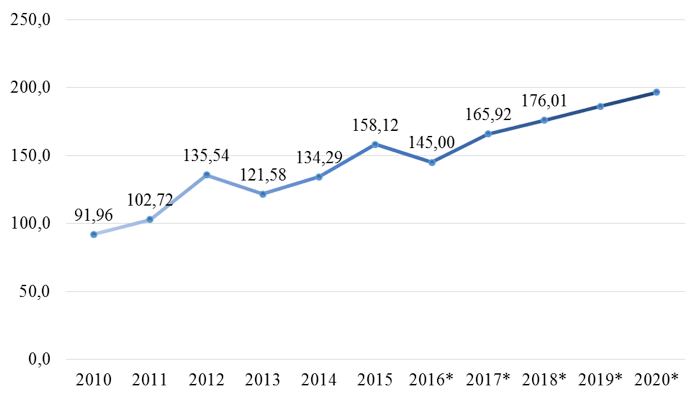

Substituting the data into equation (4), the predicted values of the resulting indicator of the model can be found, which allows to present them in the form of a chart shown in Figure 6.

Figure 6

Forecast of prices of pork producer in Russia, rub./kg

As can be seen, the model describes the drop in the resulting indicator in 2016 (145 rub./kg), however, there is a rise in prices in subsequent periods (by 14% in 2017, by 6% in 2018, by 5.7 % in 2019).

In the future, a similar situation is observed in favor of an increase in the resulting indicator but with lower growth rates, which indicates the stabilization of prices on the pork market and the optimistic prerequisites for the development of pig-breeding companies.

Since the forecasting was carried out taking into consideration the real income of clients, the resulting prices described the real possibilities of the buyers, i.e. the calculations could be used to determine the target price.

Conducting price monitoring and determining competitive advantages that were carried out at stage 3 are the task of the marketing department.

Results of monitoring regional competitors and competitive advantages of CJSC "CapitalAgro" are presented in Table 1.

Table 1

Competitors of CJSC "CapitalAgro" in the production of meat semi-finished products for 2015

Name |

Product type |

Volume of production, thous. tons |

Selling price, rub. |

Competitive advantages |

|||

AIH "Miratorg" LLC |

Semi-prepared meat and meat-contained products |

369.9 |

130.14 |

Vertical integration (proprietary feed production, breeding, meat processing, distribution) |

Diversification of production (pork, beef, production of semi-finished products). |

Availability of the forming proprietary retail network |

|

"GC Agro-Belogorye" LLC |

162.9 |

145.12 |

Availability of proprietary slaughter production |

||||

"Rusagro GC" LLC |

183.8 |

144.70 |

|

|

|||

The conducted research allowed to define the structure of basic costs of meat processing plants of the Belgorod and Bryansk regions; it is presented in Table 2.

Table 2

Structure of basic costs of meat processing plants under study

Name of the cost |

2016 |

Depreciation |

1.09-2% |

Wages (production) |

3.8-5% |

Insurance contributions (production) |

1-2% |

Gas |

0.5-0.9% |

Electricity |

1.25-1.9% |

Materials for salting and marinating the products |

0.09-0.18% |

Packaging and boxing |

3-3.85% |

Raw materials for processing |

85-88% |

Since the raw materials accounted for the largest specific weight in the product structure, the cost of meat raw materials was calculated using formulas (3) and (4) at the fourth stage taking into consideration the value of dressing (Table 3).

Table 3

Cost price of meat raw materials taking into consideration the value of dressing

Name |

Yield, % |

Q, kg |

Praw, rub./kg |

P, rub./kg |

BPR |

UPC, rub./kg |

PC, rub. |

Raw materials (bone-in meat) |

100.00 |

17,765,196.48 |

97.22 |

х |

х |

х |

1,727,171,880.00 |

Pork tenderloin |

1.20 |

213,182.36 |

х |

270.76 |

2.39 |

172.92 |

36,862,435.31 |

Pork neck large piece |

6.00 |

1,065,911.79 |

х |

239.89 |

2.12 |

153.20 |

163,298,301.19 |

Pork shoulder boneless large piece |

3.90 |

692,842.66 |

х |

193.20 |

1.71 |

123.38 |

85,485,016.73 |

Pork knuckle |

3.30 |

586,251.48 |

х |

108.98 |

0.96 |

69.60 |

40,801,771.12 |

Pork loin on bone large piece |

11.50 |

2,042,997.60 |

х |

224.42 |

1.98 |

143.32 |

292,804,448.32 |

Pork breast on bone in skin large piece |

13.50 |

2,398,301.52 |

х |

200.97 |

1.77 |

128.35 |

307,810,388.41 |

Pork ham boneless no skin large piece |

15.05 |

2,673,662.07 |

х |

195.25 |

1.72 |

124.69 |

333,384,814.75 |

Pork shank |

3.95 |

701,725.26 |

х |

107.72 |

0.95 |

68.79 |

48,273,825.06 |

Trimmed pork with the content of fat and chain muscle no more than 30% |

5.00 |

888,259.82 |

х |

120.42 |

1.06 |

76.90 |

68,310,411.12 |

Trimmed pork with the content of fat and chain muscle 50% to 85% |

3.40 |

604,016.68 |

х |

137.07 |

1.21 |

87.54 |

52,873,687.72 |

Fat back |

2.70 |

479,660.30 |

х |

150.88 |

1.33 |

96.36 |

46,218,272.78 |

Fat side |

2.50 |

444,129.91 |

х |

146.12 |

1.29 |

93.32 |

41,444,599.21 |

Set for borsch |

6.80 |

1,208,033.36 |

х |

64.54 |

0.57 |

41.22 |

49,791,607.29 |

Soup bone |

2.30 |

408,599.52 |

х |

21.48 |

0.19 |

13.72 |

5,605,061.54 |

Pork skin |

5.50 |

977,085.81 |

х |

43.58 |

0.38 |

27.83 |

27,193,692.81 |

Pork back legs |

1.90 |

337,538.73 |

х |

33.74 |

0.30 |

21.55 |

7,273,056.33 |

Pork intermammillary part |

1.50 |

266,477.95 |

х |

135.92 |

1.20 |

86.80 |

23,130,919.48 |

Chain muscle and grits from trimming |

0.50 |

88,825.98 |

х |

24.95 |

0.22 |

15.93 |

1,415,333.63 |

Pork cutlet meat |

4.19 |

744,539.38 |

х |

178.58 |

1.58 |

114.05 |

84,911,937.65 |

Pork raw fat (net) |

0.01 |

1,598.87 |

х |

70.00 |

0.62 |

44.70 |

71,475.77 |

Pork raw fat |

1.80 |

319,773.54 |

х |

50.00 |

0.44 |

31.93 |

10,210,823.79 |

Peeling |

0.30 |

53,295.59 |

х |

0.00 |

0.00 |

0.00 |

0.00 |

Losses |

0.20 |

35,530.39 |

х |

0.00 |

0.00 |

0.00 |

0.00 |

Bone scrap |

3.00 |

532,955.89 |

х |

0.00 |

0.00 |

0.00 |

0.00 |

The cost of raw materials is indexed in further calculations, and it is assumed that the remaining costs will not change.

The conducted research into competition in the Russian meat processing industry in the production of meat semi-finished products indicate a sufficiently high level of competition. Statistical data demonstrate low incomes of major population of the country, and as a consequence – limit the possibilities of increasing the products’ price. Price minimization suggests possibility of cost-cutting and obtaining additional profits, while maintaining the products price. Lean production system is focused on reducing costs and losses. As such, price reduction is the optimal strategy in the current situation.

V.S. Plotnikov and O.V. Plotnikova (Plotnikov, 2014) introduce the concept of business accounting and describe it as accounting, where the emphasis in shaping information for the future is shifted to the processes of creating value over time. In our opinion, managerial accounting today is intended to perform the functions of business accounting, and therefore to form various kinds of forecasts that would allow economic agents to properly build their future business processes. This idea is confirmed by the studies conducted by L.A. Zimakova, A.V. Kovalevskaja, S.N. Kovalenko, S.P. Mashirova and N.I. Bykanova (Zimakova, 2016).

Two basic pricing methods are distinguished in the classical economic literature: cost-based and based on market environment and analysis of demand. Each of the options has its pros and cons. N.F. Neburchilova, I.V. Petrunina (Neburchilova, 2016) emphasize that production cost serves as the lower limit of price and demand for products serves as the upper limit of the price in the practice of setting prices for meat and meat products today. Besides, it is important to take into consideration the qualitative characteristics of the product using the consumer properties’ coefficients. E.V. Orlova and I.S. Ulmasova (Orlova, 2015) propose integration of these methods and mention the possibility of describing the dynamics of some indicators and preferences using a situational analysis model and making decisions on changing the price of products sold. This research is based on the fact that producers have limits on cost reduction, which is associated with the cost of raw materials, the proportion of which in the production cost of meat processing companies is more than 80%. As a result, it is required to make predictive calculations of production cost. At the same time, an important component is focus on consumer, whose interests are not always predictable.

According to the research by Salah, W, Zaki, H. (Salah, 2013), an average accountant in a manufacturing organization spends up to 75% of their time on accounting and less than 10% on process analysis and improvement. In the context of high automation of accounting, the time spent collecting information should be reduced, while the time for analysis, forecasting and modeling should be increased.

C. Drury (Drury, 2008), when describing the management information subsystem, notes that many of the unforeseen variables are abstract or theoretical parameters that cannot be measured directly, which also necessitates the use of modeling and forecasting.

According to J. A Mingers (Mingers, 2006), factor analysis is the most important component of predictive calculations, assuming the determination of the influence of a certain factor or group of factors on the indicator under study; it is expedient to use it as an important step in the process of studying the properties of the objects under study.

The authors consider various factors that affect the pricing process in theoretical studies: market state and dynamics; price elasticity of demand, prices of competitors, competitive positions of the company, product life cycle stage, etc. (Rakhlis, 2014). The following most important external factors determining prices in the market of semi-finished meat products among the described factors were identified, which can be included in the mathematical model of development of the price market environment: per capita income, production volume, evaluation of demographic situation, average annual production per capita.

Per capita income is an indicator of the country's economic well-being, which measures the average income received by a single person in the country per year. According to Е. Nikulina, I.Chistnikova, Yu. Lyshchikova, A. Orlova (Nikulina, 2013), per capita income by region should be taken into consideration during calculations. But since the products of meat processing organizations are sold on the territory of a large number of Russian regions, this research was based on statistical data for Russia as a whole. Analysis of statistical data allowed to derive the trend equation and carry out further prediction calculations.

The authors proceeded from the equality of production and consumption volumes when calculating the consumption of meat products per capita. The conducted research into financial statements of economic agents engaged in production of semi-finished meat products revealed that these organizations had small stocks of raw materials (based on the daily demand for processing) and very low stocks of finished products. This is why, due to the specifics of the industry, the assumption is allowed about the equality of pork production and consumption volume as part of modeling for the convenience of evaluation.

Building the economic and mathematical model of development of the pork market price environment involves correlation and regression analysis. According to J. Mingers (Mingers, 2006), the above-mentioned types of analysis can be used to confirm or overturn possible explanations while statistical significance is not treated as an indicator of the theoretical model corresponding to objective reality. S. Modell (Modell, 2007) emphasizes that more reliable explanations can be obtained by combining these methods with an element of abductive reasoning and additional qualitative data. Abductive reasoning extends theoretical hypotheses, when quantitative methods give unconvincing results. This is why qualitative assessment of the results of the conducted analysis is required, which should be provided by specialists. But it cannot be denied that qualitative assessment allows for some subjectivism.

An important step in determining the price strategy is conducting price monitoring and determining competitive advantages.

The product concept is a pricing factor that has not only an external strong influence on prices, but a direct internal influence as well. When developing the product concept, the task is solved to form a unique product offer, a distinctive advantage, which will be a characteristic difference and a basis for "branded capital" on the market. For example, production of semi-finished products from marble pork allows to occupy a market niche, where competition is not as strong as in the mass segment. If prices fall below production cost and there is overstocking of warehouses on the pork market as it has been during some periods (November-December 2015), then the company can avoid price competition, which is often devastative for all its participants, by choosing a "marble" niche.

It should also be noted that semi-finished products from "marble" meat are targeted to the premium market segment, which differs by high positioning by price targeted on consumer with above average income.

Fluctuations in prices for products are virtually eliminated in this segment, because all attention is paid to the competitive advantages of the product, its characteristics – both taste and the ones that are determined by the quality of processing, convenience of cooking and, of course, brand or trademark.

The pricing process involves an integrated approach combining market principles and taking the production cost into consideration. As such, long-term planning requires definition of fundamental hypotheses.

Hypotheses can be used in a simple long-term planning model. They can be as follows in the cost planning:

- all costs are proportional to the sales volume (basic hypothesis);

- there is no seasonality;

- current year (quarter) is used as the base period. The basic percentage structure of costs relative to revenue (sales volume) is calculated on its basis;

- cost structure is optimal for a given sales volume;

- structure of assets is optimal for a given sales volume (there are no "excess" current and non-current assets).

Disadvantage of this model is that it is difficult to take seasonal fluctuations and a partly permanent nature of costs into consideration. Hypothesis clarification is based on clarification of the forecast of costs through the introduction of additional hypotheses and information on the parameters of the financial plan, behavior of costs, structure and behavior of assets, and investment. Such additional hypotheses (assumptions) can be, for example, as follows:

- sales costs are partially permanent, so their decline is slower than decline in sales;

- demands for higher wages increase the planned percentage of direct labor costs relative to revenue.

The following hypotheses can be distinguished based on the principles of the lean manufacturing system and industry specifics:

- direct costs structure will not change,

- growth in prices has a direct impact on the cost of raw materials (the pace of forecast growth in prices for finished products will correspond to the pace of growth in raw material prices),

- lean production assumes no changes in other direct costs (no plans to increase wage rates, the bonus fund depends on production volumes, while economic agents are limited by production capacities, deductions to extra-budgetary funds directly depend on the size of the wage fund, amount of depreciation is stable, because a quite new modern equipment is used).

The predictive calculation of production cost has certain industry-specific features. Technology of dressing pork sides implies receiving a wide range of meat raw materials with different consumer value in result. The cost price of processed raw materials with low consumer properties turns out to be overestimated. For example, at a purchase price of a pork side of 97 rub. (ex VAT), the selling price of pigskin (processed raw materials) is 44 rub. (ex VAT). From the standpoint of margin analysis, this type of finished product is unprofitable. However, considering that production of this product type is inherent in the technological process, it is impossible to reduce production of "loss-making" products. As such, the consumer value of dressing must be taken into account in order to correctly calculate the cost of meat products.

Definition of the price strategy can be based on the main competitive strategies in a competitive environment, recommended by M.Porter (Porter, 1985):

- cost-based leadership is focused on achieving a competitive advantage of the enterprise resulting from the lower production costs;

- differentiation involves attributing certain qualitative or distinctive characteristics to the product, which allows to distinguish it from the totality of similar products (thereby attracting the buyer);

- target is to focus on a particular market segment and improve its service.

There are three approaches to pricing based on these strategies:

- price maximization strategy,

- price reduction strategy,

- mixed strategy.

Price maximization involves receiving additional profit by setting the maximum price. This becomes possible in the case of:

- low competition or lack thereof,

- sufficient funds for development and implementation of distinctive characteristics,

- availability of buyers’ funds.

Focus on achieving long-term goals implies using the predictive calculations as part of management accounting. Choice of the price strategy is one of the tasks that need to be solved by commercial organizations while defining the priority areas of development. To do so, the authors developed stages of analysis and modeling that involve using the mathematical and statistical methods, predictive calculations based on statistical indicators and data of economic agents, as well as analytical conclusions that include the following: analysis of external factors, building of an economic and mathematical model for the development of price market environment on the basis of a multifactorial correlation and regression analysis, monitoring of prices and determining competitive advantages, predictive calculation of production costs, definition of the price strategy. Comprehensive and step-by-step calculation allows to use the obtained data for long-term planning and accelerates the process of pricing decision-making, based on the integration of market and cost approaches.

Borodin, K.G. (2015). Prognozy razvitiya tovarnykh rynkov v usloviyakh menyayushchikhsya mer zashchity i investirovaniya (na primere rynkov myasa) [Forecasts for development of commodity markets in the context of changing measures of protection and investment (by the example of meat markets)]. Problems of forecasting, 3,54-65.

Chenhall, R H.and Morris, D.(1986). The Impact of Structure, Environment, and Interdependence on the Perceived Usefulness of Management Accounting Systems. Accounting Review,1 , 16-35.

Drury, C. (2008). Management and Cost Accounting, 7th Edition, Cengage Learning.

Federal Service of State Statistics of the Russian Federation. Date View May 04, 2017 http://www.gks.ru/free_doc/new_site/population/demo/progn1.xls

Gordon, L A. and Natayanan, V. G.(1984). Management Accounting Systems, Perceiveff Environmental Uncertainty and Organizational Structure: An Empirical Investigation. Accounting Organizations and Soctefy, 9(1), 33-47.

Kuzmin, A.M., Vysokovskaya, E.A. (2013). Teoriya obstoyatelstv LOURENSA-LORSHA [Contingency theory of Lawrence-Lorsch]. Quality management methods,7, 11.

Mia, L. and Chenhall R.H.(1994) The usefulness of management accounting systems, functional differentiation and managerial effectiveness. Accounting, Organizations and Society,19(1),1-3.

Mikhailova, D.V.(2014). K voprosu ob analiticheskikh vozmozhnostyakh bukhgalterskoy otchetnost [On the issue of analytical capabilities of accounting statements]. Karelian scientific journal,4, 125-127.

Mingers, J. (2006). A critique of statistical modelling in management science from a critical realist perspective: its role within multimethodology. Journal of the Operational Research Society,57, 202-219

Modell, S, Morris, R. and Scapens, B.(2007). Mixing Qualitative and Quantitative Methods in Management Accounting Research: A Critical Realist Approach. Social Science Research Network. Date View May 04, 2017 http://papers. ssrn. com/sol3/papers. cfm.

Neburchilova, N.F. and Petrunina, I.V. (2016). Printsipy opredeleniya potrebitelnoy stoimosti myasa i myasnykh produktov na osnove pokazateley kachestva- koeffitsiyentov potrebitelskikh svoystv [Principles of determining the consumer value of meat and meat products on the basis of quality indicators – the coefficients of consumer properties]. Theory and practice of meat processing, 3, 81-95.

Nikulina, Е., Chistnikova, I.V., Lyshchikova, Yu.V. and Orlova, A. (2013). The formation of priority directions of social and economic development of the region. World Applied Sciences Journal, 22(5), 608-615.

Orlova, E.V. and Ulmasova, I.S. (2015). Tekhnologiya upravleniya tsenoy na otraslevom rynke s differentsirovannym produktom [Technology of price management on the industrial market with a differentiated product]. Science and education: scientific publication of the Bauman MSTU, 10,310-330

Plotnikov, V.S. and Plotnikova, O.V. (2014). Biznes-uchet i integrirovannaya otchetnost [Business accounting and integrated reporting]. International Accounting, 13, 25-34.

Porter, M.(1985). Competitive Advantage. New York: The Free Press

Rakhlis, T.P., Mironova, A.P. and Zhaksalykova, A.S. (2014). Sovremennyy mekhanizm tsenoobrazovaniya na predpriyatiyakh chernoy metallurgii: obosnovaniye i funktsionirovaniye [Current pricing mechanism at steel industry enterprises: substantiation and functioning]. Fundamental and applied research in the modern world, 2(6), 48-56.

Russian Statistical Yearbook 2016. Statistical Bulletin (2016). Moscow: Rosstat. Date View May 04, 2017 http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/publications/catalog/doc_1135087342078

Salah, W. and Zaki, H. (2013). Product Costing in Lean Manufacturing Organization. Research Journal of Finance and Accounting, 4(6), 86-98

Schneider, V.V. (2014). Obyektivno-oriyentirovannyy podkhod k formirovaniyu upravlencheskogo uchyota [Object-focused approach to shaping the management accounting]. Vector of science of the Togliatti State University. Series: Economics and management, 2 (17), 62-64.

Usatova, LV., Shock, I.A. and Kaluska N. A.(2015).Aspects of Expense Formation for Analytical and Reporting Support of Management of Business Processes of the Organization. International Business Management, 9 (5), 955-958

Ushanov, I.G. (2014). Strategicheskiy upravlencheskiy uchet kak informatsionnaya osnova biznes-analiza [Strategic management accounting as an information basis for business analysis]. Baltic humanities journal, 2, 85-88.

Vakhrushina, M.A. and Orlova, E.A. (2013) Uchetno-analiticheskoy obespecheniye obosnovaniya assortimenta i tsenovoy politiki torgovykh organizatsiy [Accounting and analytical support of substantiation of the product range and pricing policy of trade organizations]. Management accounting, 12, 77-88.

Zimakova, L.A. Kovalevskaja, A.V., S.N.Kovalenko, S. P. Mashirova and N.I. Bykanova (2016). Phases of Evaluation of Projected Financial Results from Ordinary Activities of a Manufacturing Company. International Business Management, 10 (16), 3332-3337

1. Federal State Autonomous Educational Institution of Higher Education “Belgorod National Research University”, 308015, Belgorod region, Belgorod, st. Pobedy, 85.

2. Federal State Autonomous Educational Institution of Higher Education “Belgorod National Research University”, 308015, Belgorod region, Belgorod, st. Pobedy, 85. E-mail: zimakova@bsu.edu.ru

3. Financial University under the Government of the Russian Federation, Russia, 125993, Moskow, Leningradsky avenue, 49

4. Plekhanov Russian University of Economics, Russia, 117997, Moskow, Stremyanny Lane, 3

5. Voronezh State Agrarian University named after Emperor Peter the Great, Russia, 394087, Voronezh , Michurina street, 1