Vol. 38 (Nº 47) Year 2017. Page 11

SM Zulaikha FATIMA 1; Charu BISARIA 2; Ajay PRAKASH 3

Received: 10/06/2017 • Approved: 26/06/2017

2. Changing retail scenario in India

3. Prominent Organized Retail formats in India

4. Promising retailers in India

5. Drivers of Indian Retail Industry

ABSTRACT: Indian retail sector has been an attractive sector over a past decade. Lot of dynamism has been witnessed in the recent past in this sector. This research paper focus on building a picture of changes that an Indian retail sector is going through. These changes are viewed with respect to big retailers/companies that are entering into this segment. The findings of the paper depicts that there has been development in the malls in northern and western part of the country. Keywords: Retailing, retail scenario, consumer behaviour, India. |

RESUMEN: El sector minorista indio ha sido un sector atractivo durante una década pasada. Gran parte del dinamismo ha sido testigo en el pasado reciente en este sector. Este trabajo de investigación se centra en la construcción de una imagen de los cambios que un sector minorista indio está atravesando. Estos cambios se ven con respecto a los grandes minoristas/empresas que están entrando en este segmento. Los hallazgos del documento describen que ha habido desarrollo en los centros comerciales en la parte norte y oeste del país. |

Indian organized retail industry at its transformation phase. Emergence of variety of stores in India clearly indicates growth in the organized retail sector and is expected to avail the status of an industry in near future. The Boston Consulting Group and Retailers Association of India (2015) published a report titled, ‘Retail 2020: Retrospect, Reinvent, Rewrite’, highlighted that India’s retail market is expected to nearly double to US$ 1 trillion by 2020 from US$ 600 billion in 2015. The size of India's retail market was estimated at US$ 600 billion in 2015. Of this, US$ 552 billion (92% of the market) was traditional retail and US$ 48 billion (8% of the market) was organized retail. Also, the overall retail market is expected to grow at 12 % per annum, while organized retail is expected to grow twice as fast at 20% per annum and traditional trade at 10%. Increase in population along with higher disposable incomes are the major factors that contributed in attaining this growth.

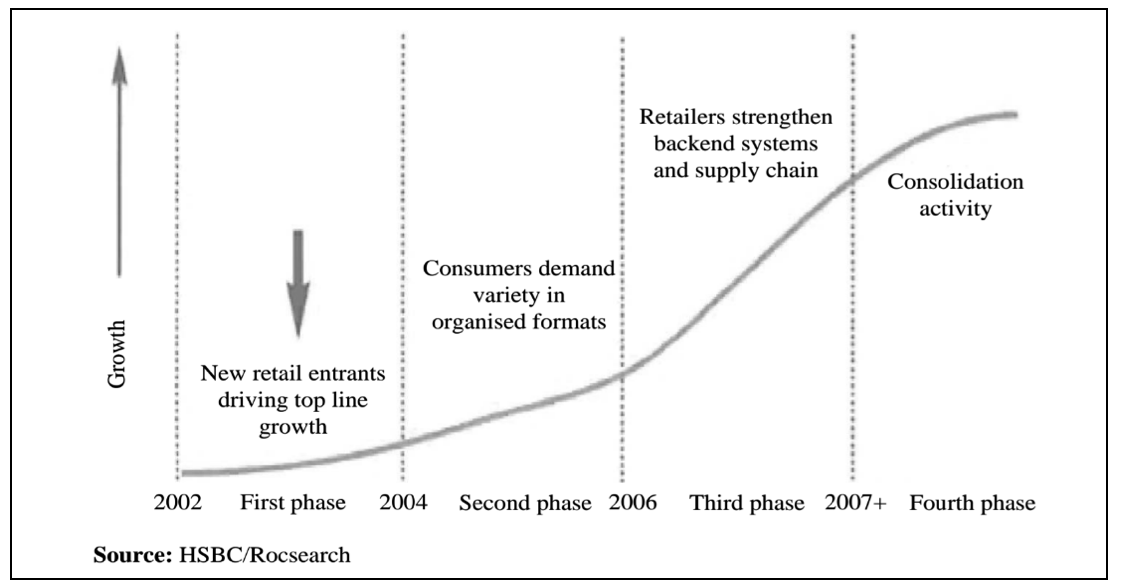

Organized retail market in India is expected to progress from novel experiment to innovative scale as depicted in figure 1. Food & Grocery segment is the backbone of retail sector in India. Research shows that with the current market size at US$455, the segment is expected to grow at around 15 percent per annum over next decade. Big players has a great opportunity to enter into Indian retail market. The overall Indian retail scenario is influenced by income growth, urbanization, changes in demographic profile and socio economic environment.

Figure 1: Organised retail is moving from being a 'novel' experiment

to expected backend innovation and scale build up

The supply of organized retail space in 2013 was around 4.7 million sq. ft. It depicts around 78 percent growth in total mall supply (2.5 million sq.ft.) in 2012. The first half of the year 2016 reported an addition of approximately 1.5 million sq. ft. of organized retail supply which is majorly centralized in Pune, Bangalore and National capital region (NCR). Figure 2 depicts the penetration of organized retail in percentage terms as compared to other South Asian countries. Approximately, 55.95 million people will be required by 2022. According to Global Retail Development Index, India is at number two position among 30 developing countries. Also, India reports the national retail sales of US$ 1009 billion in the same year. India is expected to take over China and secures the first position in global retail development index in coming years.

Figure 2: Penetration of organized retail

Source: India retail report, 2013

The retail sector in India has shown a tremendous growth over the past decade but still it could not attain the status of an ‘industry’. The Indian retail sector is dominated by traditional retail formats which are independently managed by the owners themselves. It consists of Kirana shops, weekly markets, neighbourhood shops, street shops and hawkers, public distribution system etc. They have been into existence since a very long time in India. On the contrary, recent developments in retailing formats transformed the retailing environment into the sophisticated one. Emergence of new formats like hypermarkets, supermarkets, retail chain stores, department stores, discount stores, speciality stores and malls in India are providing impetus to this boom. It is expected that malls will have the major share in the total retail development in future. The growth of 35-40 percent per annum is predicted in mall market, forming approximately 90 percent of the total retail development. Acceptance of retail culture among customers gives developers an opportunities to set up malls. This trend is most visible in big metro cities which is now been extended to smaller cities of the India. Retailers are expanding their business activities to smaller cities as they are the lucrative places to invest in (due to low rentals, larger availability of land, low operational and functional expenses etc.). Apparel segment is the most attractive segment and is expected to avail the highest share in the total space of mall. Figure 3 shows the breakup of mall space by formats.

Figure 3: Breakup of mall space by formats

Among the recent changes in retailing in India emergence of a new format which is a combination of retail and entertainment spots under one roof is becoming very popular among the people especially the youth. Though there exists lot of malls in India but now the focus has shifted on developing malls that offers platform for leisure activities also. Ample amount of multiplexes are a part of malls along with facilities like gaming zones, food courts etc. that attracts the customers towards them.

Malls are expected to rule the organized retail sector in future but still their sustainability is debateable. A while later this development will lead to questioning value proposition a mall can give with respect to competition in order to sustain in the Indian retail market. At last the malls that provide value-for-money proposition to its customers will only be the one that will go long way and survive in future.

These are those stores that offer wide variety of merchandise categories, generally organized into departments. They are self-service stores and usually very big in size. These stores are witnessing phenomenal growth in India. Big Bazaar, More, Spencer hyper, Trent are the prominent players in this category. People are getting attracted towards this format as they can buy everything from toiletries to home appliances and groceries under one roof. Pantaloon Retail leads this format having 512 big bazaar stores and online franchisees which are currently operating in India as of 2016.

Departmental stores are the retail establishments that offer wide variety of consumer goods. These stores sell goods through various departments such as apparel, footwear, home appliances, electronic, stationary, food items etc. within the store. They are usually found on a high street or as anchor stores in shopping malls. Customers are getting different experience in these stores as they are offered a novel and variety of products with an international ambience under single roof. This format is gaining popularity among Indian customers. With the entry of big players has revolutionized the entire retail scene in India. Pantaloon , Westside, Shoppers Stop, Reliance Trends, Wal-Mart are the most successful players in this category of format in terms of reach, turnover and profitability. In this category also, Pantaloon is the leader having 104 stores as of 2016.

These are the modern form of mom-and-pop stores located near residential areas. They are retail businesses that operate in less than 5000 square feet area and enables customers to purchase quickly with speedy check-out. These stores provide limited variety and assortments of products to its customers. They specialize in selling food, gasoline and various consumable products. More, Spencer’s daily, Reliance Fresh are among the prominent retailers in this category having approximately 499, 134, 700 stores respectively. Convenience stores are springing up all over in India as they are easily approachable by the customers and caters to their daily needs.

These are those stores that specialize in one type of a product. They tend to specialize in apparels, books, toys, jewellery, shoes etc. These stores offer large number of products within each product line (depth) but they do not offer large number of product lines (width) to its customers. Mumbai’s bookstore crossword, RPG’s Music world are the examples of specialty stores in India. There are 430 world of titan stores, 174 Tanishq stores, 336 Titan eye+ stores operating in India.

Landmark group is one of the most successful player in India retail market. Its stores are spread across the world. It started its operation in 1998 in India. With an estimated annual revenue of $6 billion, Landmark has more than 2200 stores spread across the Middle East, Africa and India as of 2017. The basic reason for getting successful in India is its experience of running retail stores abroad. Apart from this, the reason behind their success is manufacturing of its private label brand that attracted the customers to buy from the premium store at low costs. Approximately, 11percent of the total merchandise at Lifestyle stores comprises of private label brands. Lifestyle plans to open more stores by the end of the year to alone achieve a target of nearly Rs 6750 crore turnover in 2017. The company also plans to enter tier II cities apart from Tier I cities including Bangalore, Delhi, Agra, Indore, Lucknow and Howrah. The focus will be on opening around 25-30 Max stores, 10-12 Lifestyle stores and 3-4 Home centres in these cities.

RPG’s retail empire is one the biggest empires in India having approximately 100 stores. Foodworld (Joint venture with Hong-Kong based Dairy Farm International), Music world (50:50 joint venture with Dairy Farm International), Health & Glow (Cosmetics & Health products) and Giants (hypermarkets) are all launched under its banner. In 2006, the joint ventures under the name of Giant and Foodworld was terminated and RPG was able to retain only 48 stores out of its 93 stores. Later, RPG launched its largest supermarket under the brand name Spencer’s that revolutionized the entire retail scene in India. Their strategic decision of offering everything under the same roof made them successful in India. The company claims to have 305 million footfall and about 1 million loyal shoppers in the country. It has 32 large format stores in 30 cities and is planning to open 100 retail stores by the end of 2017.

K Rahega group is trailblazer for organized retail in India by introducing establishing an organized retail store in Mumbai which is popularly known as Shoppers Stop. The group is showing a stupendous growth across the country. Shoppers Stop is planning to expand its business by opening 100 stores by 2020 but it will not look for new cities in order to save on its marketing and logistic costs. Also, company is targeting to open approximately six to seven Shoppers Stop stores and two to three HyperCity stores annually. Shoppers Stop in-house brands like Stop, Kasish, Life makes them unique and contributes to around 20 percent of its total turnover.

Tata group is one of the most renowned groups in India. Titan Industries, Infinity Retail, Landmark and Trent are owned by this group comprising of revenues of about Rs 17000 crore. Though the group has increased its number of retail stores but still they did not achieve the same grow rate as that of other retail giants like Future group or Reliance Industries. The Tata group is now focusing on expanding its hypermarket (food and grocery) and lifestyle business by entering into joint venture with UK- based company Tesco, which would be investing upto Rs 850 crore. With this, it is expected to open more stores of different sizes and formats all over the country. Also, its Barista Coffee Company is focusing on opening 160 espresso bars in India as well as in foreign countries in future.

Apart from the above mention retail retailers ITC Lifestyle, Globus, Café Coffee Day, Subhiksha etc are also very famous retailers in Indian retail market.

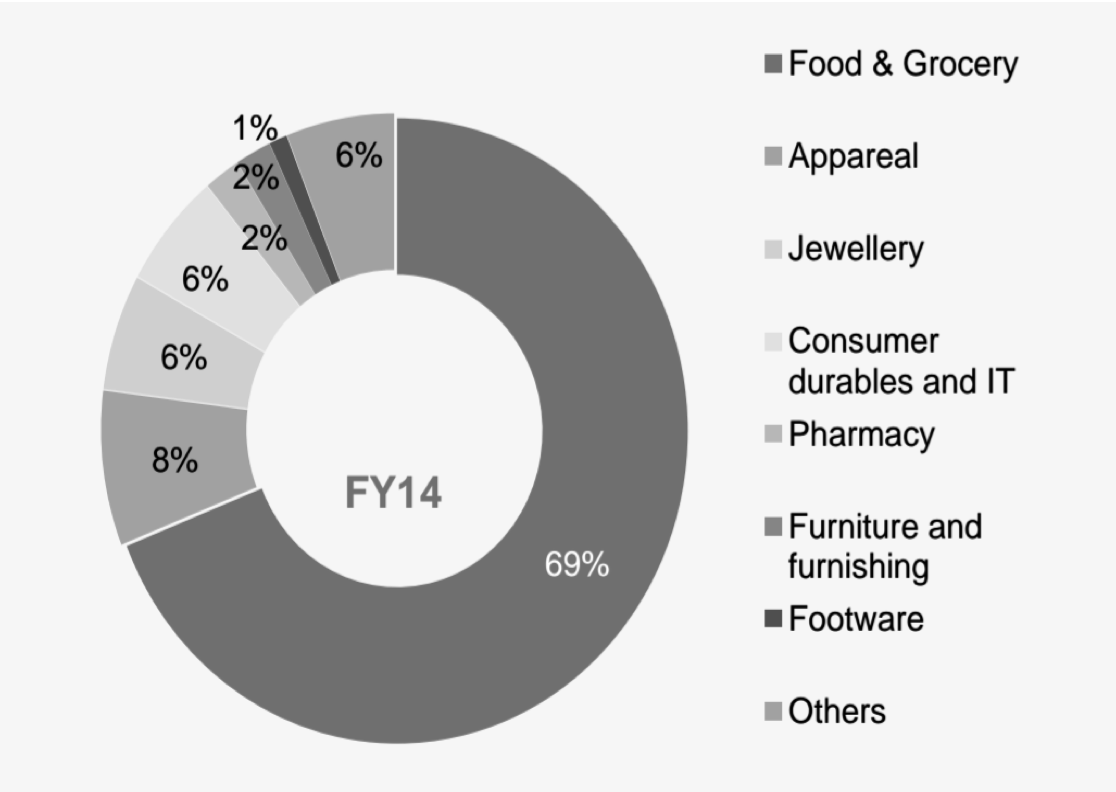

Currently, food & grocery and apparel segment are driving the Indian retail market. It is depicted in figure 4

Figure 4: Segment Share of Organized retail in India

Source: www.ibef.org

Food retailing is the fastest growing segment in Indian organized retail sector. According to a research conducted by India brand equity foundation food and grocery retail (69 percent) has the highest share in total retail market in India. Currently, the market size of food and grocery retail is Rs 23 lakh crore. Dry food grocery and milk & dairy products constitute 34.7 percent and 16 percent share in Indian food market. Indian food retail market is estimated to cross 35.60 lakh crore by the end of 2017 and Rs 61 lakh crore by 2020 (India Food Report 2016).Indian food market has the potential to grow three times with the current rate in coming 4-5 years. The southern region of India has observed an intense growth in organized food retail sector. Players like Foodworld and Nilgiris are expanding their boundaries of grocery market in India. Northern and western part of India is also witnessing phenomenal growth. Different formats like discount stores, supermarkets, hypermarkets jointly will go a long way in Indian retail market.

In India the concept of multi brand outlet (MBO) is becoming very popular among people due to the obvious reason of accessing variety of brands at the same place. Big retailers like Pantaloon Retail, Lifestyle and Shoppers Stop is trying to fix their retail models and are targeting to expand their store size. In-house brands is yet another very important strategy adopted by the retailers in organized sector. These brands are retailer specific brands are are generally low priced accounts for around 20 percent of total sales of the apparel retailers in India. Apparel retailers are combining supply chain management and merchandising practices into one function with collaborative efforts with the suppliers. Retailers are preferring to gain customer satisfaction so that they can improve their profitability. Global brands see India as the lucrative market to invest in because of rising per capita income, changes in spending styles and speedy growth in urban population. Customers in urban areas of the country are buying apparels at least 10-12 times a month, unlike few years back. The omni-channel retailing is the emerging trend in India that are reshaping the channel strategies of the medium sized companies that are focusing the high- tech population of India. This has given opportunities to many retail brands to enter into the Indian retail market. Global brands do not only find Tier I cities attractive for investment but also Tier II and Tier III cities especially in apparel segment. However, in India systematized merchandise planning systems and tools are still not in active use. Apparel retailers are still experimenting with different new formats (eg. Quasi mall)

The findings show that malls culture is rapidly increasing in India. Customers are favouring this concept because they can find leisure activities apart from just shopping in malls. Malls having multiplexes, food courts, gaming zones are becoming popular for family outings. Changes in income and spending patterns have also forced small retailers to upgrade themselves in order to hold their customers. Now the focus of retailing is on satisfying the different hierarchy of needs of the customers.

Retailing in India is still at initial stage and still has a long way to go. It needs to overcome various hurdles to gain the status of ‘industry’ in India. Restrictions on purchase of real estate and bulky local laws should be made easy. Also, a well-developed supply chain and integrated IT system should be made that would help retailers to perform business activities easily in India. Though, India is a highly populous country but still it faces shortage of trained manpower in retail sector. Hence, further researches are required to perform that could address the above mentioned changes and lacuna in the industry in order to become number one retail market worldwide.

India retailing Bureau (2016), “7 categories driving growth of Indian Food & Grocery retail market”, Retrieved from http://www.indiaretailing.com/2016/06/13/india-food-forum-food-grocery/7-categories-driving-growth-of-indian-food-grocery-retail-market/

Richa Maheshwari (2016), “Lifestyle International plans expansion as ecommerce threat fades”, The Economic Times, Retrieved from http://economictimes.indiatimes.com/news/industry/services/retail/lifestyle-international-plans-expansion-as-ecommerce-threat-fades/articleshow/53070591.cms

Shashikant Trivedi (2014), “Spencer’s to open 100 hypermarkets across India by 2017”, Business Standard, Retrieved from http://www.business-standard.com/article/companies/spencer-s-to-open-100-hypermarkets-across-india-by-2017-114022801414_1.html

Sujata Sachdeva (2016), “Shoppers Stop, Hyper city has big expansion, integration plans”, Retrieved from https://fashionunited.in/news/business/shoppers-stopy-hyper-city-has-big-expansion-integration-plans-p/2016010712883

Priyanka Pani (2014), “Tata group surges ahead in the retail race”, Business Line, Retrieved from http://www.thehindubusinessline.com/companies/tata-group-surges-ahead-in-the-retail-race/article6134138.ece

Press trust of India (2016), “Domestic food retail to cross 61 lakh crore by 2020: Are we prepared for rural market?”, Retrieved from https://yourstory.com/2016/01/domestic-food-retail-market/

AT Kearney(2016), “Global retail expansion at crossroads”, pp. 1-31.

CBRE research (2016), “India Retail, H1 2016”, CBRE Inc.

The Boston Consulting Group and Retailers Association of India (2015),”Retail 2020: Retrospect, Reinvent, Rewrite”

HSBC/India (2005), Retail Report, December, pp. 1-135.

KPMG (2013), “India retail report”, KPMG analysis.

1. Research Scholar, Amity Business School, Amity University. Contact e-mail: zulaikha.fatima@gmail.com

2. Assistant Professor, Amity Business School, Amity University. Contact e-mail: chrbisaria@yahoo.co.in

3. Professor, Institute of Cooperative and Corporate Management Research and Training. Contact e-mail: drprakashajay@gmail.com